The Insured Mortgage Purchase Program (IMPP) and the Extraordinary Financing Framework (EFF) is to the Canadians what the Troubled Asset Relief Program (TARP) is to Americans: A cover for hundreds of billions of dollars – trillions in the U.S. – of public funds being dumped into the coffers of parasitic monopoly financial interests.

If you’re still scratching your head with bewilderment trying to understand how the “free-market” Conservatives could make an overnight about-face into Keynesians – from promising budget surpluses during the October 2008 Federal election to giving us unforeseen budget deficits in the 2009 Budget – then you’ve bought into the terms of a “public” debate that is intended to confuse and conceal what’s really going on. The Conservatives have not broke with old ideas as a last-ditch attempt to hold onto power in Parliament, as many are saying. Rest assured that the Conservatives have been and remain the most shameless representatives of monopoly capitalist interests in this country. Over the last three months, the Conservatives – taking the lead from Bush and Obama presidencies in United States and most other imperialist countries – have begun to implement one of the largest transfers of public wealth in Canadian history, channeling untold amounts of public funds into the coffers of the banks and other monopoly financial interests, accounting for at least $275 billion in “bailout” money.

Meanwhile, the pseudo-opposition Liberals and NDPers have de-facto gone along with the ruling party’s proposals by refusing to shift the terms of the debate onto what really matters. While the attention of Canadians were being diverted by the political theatrics of the last three months – with the October 2008 elections, the prospects of an NDP-Liberal coalition, the British Crown’s representative to Canada Michaëlle Jean shutting down Parliament, and the anti-climactic display of Jim Flaherty’s “leaky budget” in mid-January 2009 – a conspiracy of silence has prevailed as the Canadian government swapped hundreds of billions of dollars for questionable assets held by Canada’s banks. This while millions of Canadian working-class were people being walloped by the economic crisis, with hundreds of thousands of lost jobs, pension funds suffering historic losses, (Footnote 1) and EI failing to pay out to workers what they pay in to it. (Footnote 2)

In order to fully take stock of what has occurred in the last three months, let’s return to October 2008 when this untold drama began unfolding.

“Cash for Trash” Under the Cover of “Credit for Consumers”

In October 2008, with the current crisis of monopoly finance capitalism in full swing and the U.S. government preparing to implement its controversial $700 billion “Troubled Asset Relief Program” to buy up junk assets from financial corporations – only one of a series of bailouts that would eventually reach some $8.5 trillion (Footnote 3) – unbeknownst to most Canadians the Government of Canada was in the process of implementing its own “bailout”.

Days before the 2008 Federal Election in Canada, Prime Minister Stephen Harper announced that the Government of Canada, through the Canadian Mortgage and Housing Corporation, would purchase “$25 billion in insured mortgage pools as part of the Government of Canada’s plan, announced today, to maintain the availability of longer-term credit in Canada.” (Footnote 4)

It’s instructive to note that with this announcement falling just four days before the Federal election either the Liberals or the NDP could have generated a groundswell of popular dissent by exposing and opposing this bailout and rode that wave right into power. They did not oppose the bailout then, and their silence on what was to follow has shown the degree to which these parties serve monopoly capitalist interests.

Emboldened by the success of the first phase of the bailout scheme having being carried through with no dissent from the Canadian people, Bay Street began publicly pushing the Canadian government to expand the plan to beyond $200 billion. (Footnote 5)

On November 12, 2008 the Canadian Department of Finance announced that it would buy up another $50 billion in securities through the Canadian Mortgage and Housing Corporation as part of its Insured Mortgage Purchase Program (IMPP):

The Honourable Jim Flaherty, Minister of Finance, today announced the Government will purchase up to an additional $50 billion of insured mortgage pools by the end of the fiscal year as part of its ongoing efforts to maintain the availability of longer-term credit in Canada.

This action will increase to $75 billion the maximum value of securities purchased through Canada Mortgage and Housing Corporation (CMHC) under this program. (Footnote 6)

Simultaneously, the government also announced that they would indeed “guarantee… more than $200 billion to pay back new loans made to Canadian financial institutions.”7

With $75 billion in the bag, and no signs of mass opposition to this massive transfer of public wealth to the banks – not even nominal opposition from any of the main federal political parties – there were no forces standing in the way of the Canadian government buying up another $200 billion of bad assets from Canada’s chartered banks.

The 2009 Federal Budget:

Unbeknownst to most Canadians, this $200 billion program has already been approved by the Canadian government in the form of the 2009 Federal Budget.

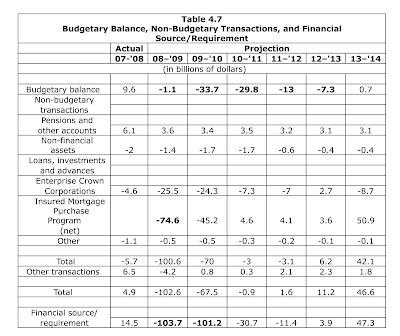

The devil is in the details of Table 4.7 of the Budget, reproduced here (click to view):

In the first line, one can find the budgetary numbers that sum up to the much discussed $85 billion deficit. In the line entitled “Insured Mortgage Purchase Program” one can find the $75 billion CMHC buyout. And then, at the very bottom of the table, in the line entitled “Financial source / requirement” one finds the $200 billion + in additional funds. How does the budget explain this massive financial expenditure?

In its own words, the

significant financial requirements are projected from 2008–09 to 2011–12, respectively of $103.7 billion in 2008–09, $101.2 billion in 2009–10, $30.7 billion in 2010–11, $11.4 billion in 2011–12, as well as financial sources of $3.9 billion in 2012–13 and of $47.3 billion in 2013–14. The requirements result largely from government initiatives to support access to financing under the Extraordinary Financing Framework (EFF). (Footnote 8)

And there it is: The “Extraordinary Financing Framework” (EFF) – a mere footnote buried in the 2009 Budget to account for one of the greatest financial raids of public funds in Canadian history, the consequence of which will be a public debt so large that it will have to be serviced through the mass privatization and elimination of the social programs which Canadians take for granted. Google Canada’s “Extraordinary Financing Framework” and you get under 300 hits. By comparison, Google the U.S. $700 billion “Troubled Asset Relief Program”, and you get more than a million hits.

Worry not, the Budget reassures us, since “the large increase in market debt associated with the Insured Mortage Purchase Program (IMPP) does not affect federal debt or the federal government’s net debt levels as the borrowings and associated interest costs are matched by an increase in revenue-earning assets (my emphasis).”

If the bank assets purchased under the IMPP and to be purchased under EFF are indeed stable revenue-earning assets, does this not raise the question of why these institutions are liquidating them? For liquidity, of course, so the banks could get on with their lending – or so we’re told.

If these assets are generating profitable revenue streams, then these banks would have little need to dispose of them. In the current climate of hundreds of thousands of jobs being wiped out in the Canadian economy, the default rate on consumer and household debt is set to soar, and these assets will be hit hard, just as they were in the U.S. with the sub-prime mortgage debacle. And when these assets default, it will be Canadians who will be left to foot the bill.

And what are the banks planning to do with all of this “liquidity”?

In response to the January 27 budget, Ottawa-based economist and editor of globalresearch.ca Professor Michel Chossudovksy wrote “We are not facing a budget deficit of Keynesian style, which encourages investment and demand for consumer goods and leads to increased production and employment.” Rather, as he points out,

Canadian chartered banks will use the money to salvage the time to consolidate their position and fund the acquisition of several U.S. financial institutions' problem… For example, in 2008, TD Canada Trust has acquired Commerce Bancorp of New Jersey, making it the second largest transaction of a Canadian mergers and acquisitions valued at $ 8.6 billion U.S.9

The massive deficit accounted for in the 2009 Federal Budget is not directed at “stimulus spending” to create jobs for unemployed workers in the “real” productive economy, invest in public infrastructure to renew decaying and underfunded public services, or increase accessibility to Employment Insurance and welfare benefits. This is one of the boldest and most overt series of attacks by monopoly capital on the vast majority of Canadians.

The players may have changed, but the game remains the same. As V.I. Lenin demonstrated nearly a hundred years ago in Imperialism, The Highest Stage of Capitalism and other works, capitalist crises are the opportunity for greater concentrations of wealth and monopolization of industry. Canada’s present experiences with the IMPP and EFF are evidence of where that wealth comes from and where that wealth is going.

Economic Crisis as a Prelude to Social and Political Crisis

There is no shortage of resources in our economy or at the disposal of our state to meet the challenges and resolve the social crises that the majority of Canadians are facing in the current economic crisis; only a shortage of political organization among the working-class and other modest-income to have a meaningful say over how these resources are spent; or, for that matter, the operation of the entire economy.

So, if the “open and democratic” liberal society that Canada is couldn’t produce a single dissenting political current in the electoral realm, a single voice of opposition in our “free press” (which is actually one of the most concentrated in the industrialized world), if only a handful of Canadians are writing about Canada’s bailouts, and such a small fraction of Canadians even know about it, while millions will experience the devastating social and economic consequences, what does this tell us about the nature of political power in Canada? And if it simply can’t deliver to goods for us, what comes next?

Left to the devices of Canada’s monopolistic ruling-class, the solution to the current crisis will be the complete gutting of social spending, a new round of attacks on organized labour and the real wage, an increased dependence on imperialism for profits, and all the militaristic campaigns that this necessitates. (In the midst of our economic crisis, we shouldn’t be holding our breath to see cutbacks in the $500 billion military budget pledged by the Conservatives in the summer of 2008).

Canada is long overdue for a serious upsurge in militant grassroots organizing with a socialist orientation. As capitalism proves itself to be nearing economy bankruptcy, we need to come to terms with how morally and politically bankrupt it is as well. What the people’s of the oppressed countries of the world or the indigenous peoples of this land have been telling us for centuries Canadians are beginning to wake up to: That Canadian monopoly capitalism is a parasitic system, and it can’t persist without the constant expansion of war, the intensification of exploitation, further environmental destruction, new territorial conquests, support for state-terrorism and state-sanctioned terrorism, and perhaps even new world wars to redivide the world’s people and resources among the major imperialist powers.

The choice is ours. It’s this bleak future, or we begin to organize ourselves for something else. That historical something else to capitalism and imperialism, as the people’s movements in places like Venezuela, Bolivia, Nepal, or the Philippines are demonstrating to us today, can only be socialism.

(1) See Steve da Silva, “Canada’s Bailouts: A Whole New Round of Attacks on the Working-Class”, BASICS Free Community Newsletter (Issue #12, Jan/Feb 2009) .[ http://basicsnewsletter.blogspot.com/2009/01/canadas-bailouts-whole-new-round-of.html]

(2) See J.D. Benjamin, “The Great Employment Insurance Rip-Off”, BASICS Free Community Newsletter (12 January 2008).

[http://basicsnewsletter.blogspot.com/2008/01/great-employment-insurance-rip-off.html]

(3) See Kathleen Pender, “Government bailout hits $8.5 trillion”, San Francisco Chronicle (26 November 2008).

[http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/26/MNVN14C8QR.DTL&hw=bailout+debt+trillion&sn=001&sc=1000]

(4) CMHC News Release, “Canada Mortgage and Housing Corporation Supports Canadian Credit Markets”, CMHC (10 October 2008).

[http://www.cmhc-schl.gc.ca/en/corp/nero/nere/2008/2008-10-10-1700.cfm]

(5) Paul Vieira, “Ottawa's steps have worked so far: Flaherty”, FinancialPost.com (22 October 2009). [http://www.nationalpost.com/related/links/story.html?id=899369]

(6) “Government of Canada Announces Additional Support for Canadian Credit Markets”, Department of Finance Canada (12 Nov 2008).

[http://www.fin.gc.ca/n08/08-090-eng.asp]

(7) Ann Miller, “Banks get all their wishes fulfilled” National Post (13 November 2008). [http://www.globaltv.com/globaltv/winnipeg/story.html?id=954383]

(8) “Chapter 4: Fiscal Outlook” of Canada’s Economic Action Plan: Budget 2009, Government of Canada (27 January 2009).

[http://www.budget.gc.ca/2009/plan/bpc4-eng.asp]

(9) Chossudovksy, “Canada: Opération «Relance économique», $200 milliards pour les banques”, globalresearcg.ca (28 January 2009).

[http://www.mondialisation.ca/index.php?context=va&aid=12076]

| < Prev | Next > |

|---|