Neoliberalism cause of the worst recession since the 1930s…

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly supposed. Indeed, the world is ruled by little else.” - John Maynard Keynes<

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly supposed. Indeed, the world is ruled by little else.” - John Maynard Keynes<

Ideas matter greatly in determining the shape and direction of our society.

The ideas underlying economic policy-making affect our lives in many ways: what is produced; the conditions under which production takes place; how production impacts the natural environment, the size and distribution of income from production; and, of course, the balance between public goods and services paid for through our taxes, and those produced by the private sector and paid for with individual incomes via the market.

The dominant economic paradigm (or set of ideas and policies) in Canada -- and most of the world over the last 30 years -- has been what I call neo-con economics, or, as it is referred to in many quarters, neoliberalism. Thirty years of escalating financial and economic instability culminated in a spectacular financial collapse that spread quickly to the real economy, causing the deepest global recession since the 1930s.

In assessing how neo-con economics has affected the well-being of Canadians in the 30 years leading up to the crisis of 2008, I address two questions. First, how does the neo-con period compare with the preceding period that emerged out of the 1930s Depression and World War II, and lasted roughly until 1980? This was the so-called Keynesian age, named after the great British economist John Maynard Keynes, whose ideas decisively shaped public policy-making during that time.

And secondly, was neo-con economics the inevitable outcome of globalization forces? Did we have to go down this road, or did we have a choice?

The 1929 stock market crash was followed by 10 long years of global depression, mass unemployment, and widespread human suffering, ending only with the mobilization to fight World War II. Governments in the 1930s were stymied about what to do. Their obsession with balancing budgets only made things worse. Keynes provided a new explanation of the Great Depression’s causes, and a prescriptions for economic recovery and for maintaining full employment over time.

Keynes argued that the capitalist economy, left to its own devices, produced prolonged periods of inadequate purchasing power or aggregate demand -- due to the inequitable distribution of income and wealth, and to uncertainty, which caused people to hold savings in cash rather than to spend it -- which led to inadequate private investment and high unemployment.

Contrary to the conventional wisdom of the day, Keynes argued that the economy would not automatically recover. To those who promised that the market by itself would return to full employment in the long run, he famously said: “In the long run we are all dead.”

Keynes prescribed a new and active role for government: 1) spending to “prime the pump” and get businesses to invest and hire once again; and 2) measures to redistribute income in order to raise the ability to consume.

His ideas for activist government to maintain full employment and regulate markets were so radical at the time that they were greatly resisted by guardians of the status quo. But eventually they helped nations pull out of the Depression and they drove the post-war economic boom. Keynes was not a revolutionary like Marx, who wanted to replace capitalism. Keynes sought to tame the inherent instability of the market -- to save capitalism from itself.

The other landmark event that launched this post-war period was the adoption by the world community of the UN Declaration of Human Rights -- one of the great documents of the 20th century.

A product of the Depression and Second World War, the Declaration uniquely combined political and civil rights — freedom of expression and assembly, freedom from arbitrary detention and search, etc. -- with economic and social rights: the right to employment, to education, to join unions, to security in the event of unemployment, sickness, or old age, etc. As John Humphries, the Canadian legal scholar who wrote the first draft of the Declaration, recounted in his autobiography, “Human rights, without social and economic rights, have little meaning for most people.”

There was all-party consensus to advance these rights — whether by the governments of Diefenbaker or Pearson or Trudeau. Canada and all provinces had by 1976 ratified the UN Convention on Economic, Social and Cultural Rights. From that date on, these rights were not simply Canadian aspirations; they became legally binding. (Ironically, shortly thereafter began the reversal of progress toward the fulfillment of these rights, which continues to this day.)

Implementing the social blueprint laid out in the 1943 Marsh report, the main social pillars of Canadian society were built or enlarged during this remarkable period: unemployment insurance, social assistance, public pensions, Medicare, public education, affordable university, etc. It was also a time of financial and economic stability. There were no significant recessions until the mid-1970s, when the Keynesian system started to come undone.

All income groups participated in the growing prosperity. Wages and living standards for all increased in tandem with the growing economy, and income and wealth inequality fell. The far-reaching reforms brought in by Canadian governments during the Keynesian era created, for the first time in our history, a broad middle-class society.

The breakdown of the Keynesian system of international monetary management (Bretton Woods), combined with the 1970s oil price shocks, accelerated the expansion of private international financial markets. The growing power of multinationals relative to labour undermined the “social contract.” New phenomena, notably high unemployment alongside high inflation (stagflation), challenged the Keynesian full employment consensus.

Into this policy vacuum stepped the redoubtable Milton Friedman, leader of the Chicago School — the epicentre of neo-con economics — with a set of clear policy prescriptions, revived from past decades in the policy wilderness.

Friedman argued that the unfettered self-regulating market was the best vehicle for achieving prosperity for society as a whole. Unleash the magic of the marketplace, he said, and private investment decisions will drive economic growth.

For Friedman, government was the problem and markets were the solution. The role of government was to get out of the way of the market, except to enforce market disciplines and protect private property and wealth.

Inequality was not a problem for neo-cons, since the pursuit of profit and wealth was the driving force behind growth, and, not to worry, the benefits would trickle down to the population — “a rising tide will lift all boats.”

Unemployment was not a problem, either (or just a short-term one) in the neo-con universe. In a self-regulating market economy, where everything that is produced is automatically spent, if unemployment emerged, falling wages would reduce labour costs, which in turn would increase profits, investment, and job creation --leading back to full employment. (Friedman saw unions as an impediment to wage reduction that needed to be neutered.) Thus, the macro-policy role of government shifted away from maintaining full employment to controlling inflation.

Friedman was backed by powerful corporate interests that saw his ideas of limited government, weakened collective bargaining power, and wage repression as enhancing their pursuit of profits. Political leaders —Margaret Thatcher in Britain and Ronald Reagan in the United States — embraced Friedman’s ideas and set in motion the counterrevolution that came to dominate policy-making in large parts of the world, including (somewhat delayed) in Canada.

Economic freedom, the freedom to make money, was at the heart of neo-con economics. Its promise -- free the market, free trade and capital, and the economy prospers and the benefits trickle down to everybody -- turned out to be a false promise. Worse, it was a perversion of the rights and freedoms enshrined in the UN Declaration. To the extent that benefits did trickle down, as John Kenneth Galbraith quipped, they were akin to the old saying that, “if you feed the horse enough oats, some will pass through to the road for the sparrows.”

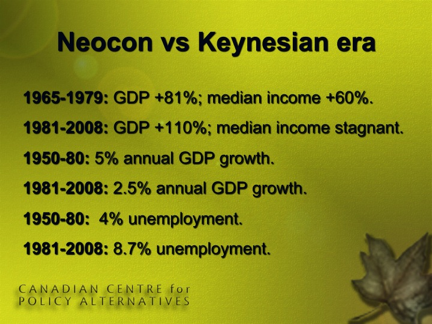

The neo-con era (1980-2008) has been one of slower economic growth — less than half the annual growth rate of the Keynesian era — with more than twice the level of average unemployment (8.7% compared to 4%). Unlike the Keynesian period, it has been marked by three severe recessions and numerous financial crises. (There have been over 100 financial crises, big and small, since the late 1970s.)

TABLE 1: Comparing the Neo-con and Keynesian Eras in Canada

Wages and household incomes have either stagnated or fallen for the large majority of people, even as GDP and productivity have grown steadily. Most Canadian families are working longer hours just to stay in the same place, or to reduce the decline in their incomes.

Inequality in Canada has grown dramatically, particularly over the last 15 years. The national income share of the top 10% doubled between 1980 and 2007. It now stands at its highest level since the late 1920s, just before the Great Crash of 1929.

Only the top 10% of Canadians have experienced significant income gains since 1980. The lion’s share of gains went to the top 1% of income earners (250,000 people with an average income of $404,500). The top 0.01% (the exclusive “2,500 Club” requiring at least $1.8 million in income to join) made extraordinary gains.

CEO salaries and bonuses have skyrocketed. The average earnings of the top 100 CEOs (now $7.3 million) ballooned from 100 times the average worker’s wage to 174 times over the last 10 years.

Stagnant wages have led to an alarming increase in personal debt as Canadians (aided by low interest rates) sought to compensate for lagging earnings. Household debt has increased six times faster than incomes since 1990 to an historic high of $1.47 for every dollar of disposable income. And family savings rates have sunk to levels not seen since 1938.

The neo-con triplets -- deregulation, privatization, and free trade — have seriously weakened the ability of unions to secure a share of productivity gains for workers. They have basically severed the link between productivity and wages. From 1988 to the present, unionization rates overall declined from 40% to less than 29%. Virtually all of this decline has been in the private sector, where the rate of unionization is now under 20% of the private sector work force. Labour’s share of national income has slipped below 50%. The flip-side, of course, is that profits’ share of the national income pie has soared to record levels.

Neo-con economics has been centrally focused on shrinking governments’ social role, on reversing the great achievements of the Keynesian era. To do this, it has successfully reduced the fiscal capacity of government — its ability to raise revenues necessary to provide social programs and public services.

Most federal and provincial governments have made major tax cuts, most of them since the mid-1990s. Between 1997 and 2005, provincial governments collectively cut their annual tax revenue by 15%, so that by 2005 they were taking in $28 billion less per year in revenue.

Federal tax revenue, under both the Liberals (2000-05) and Conservatives (2006 to the present) has also been slashed. As a share of GDP, it is now at its lowest level since the 1940s. The Harper cuts to date have left the federal Treasury with $34 billion less revenue this year alone.

Neo-cons have been very successful in separating taxes from the services they provide. They have sold tax cuts as a benefit for the middle class (best expressed by the endlessly repeated phrase, “You know best how to spend your own money.”)

As Hugh Mackenzie and Richard Shillington have shown in a landmark study for the CCPA, when you net out the benefit from tax cuts against the loss in public services, most Canadians have been losers from most of the tax cuts implemented over the last 15 years. Mackenzie and Shillington demonstrate convincingly that public services greatly enhance the living standards of the vast majority of Canadians, and are also an important vehicle of income redistribution.

The most perverse outcome of the tax cuts overall — as CCPA economist Marc Lee has shown — is that the top 1%, the main beneficiaries of the tax cuts, now pay a smaller share of their income in taxes than the bottom 10%, those Canadians with the lowest taxable incomes.

Federal program spending fell from a peak of 21% of GDP during the 1981-82 recession to 17.4% in the depths of the 1991-92 recession, to 13% of GDP during 2006-08 — with the exception of a few years at the end of the 1990s, its lowest level since the early 1950s.

Provincial spending (excluding federal transfers), which was steady at 11-12% of GDP from 1981 to 1995, dropped to 8.9% by 2005. This may not seem like a big drop, but, if it had remained constant as a share of the economy, the provinces would have had $36 billion more to spend in 2005.

Thirty years of neo-con economics have raised the level of insecurity for millions of Canadians. Our research with Environics reveals that, even before the current deep recession, half of Canadians believed they were only one or two pay-cheques away from poverty.

Provincial social assistance programs are now a pale shadow of what they were in the recession of the early 1990s. Our unemployment insurance system has been gutted. In 2009, during this recession, less than half the unemployed were considered eligible to receive unemployment insurance benefits. During the 1990s recession, well over 80% of unemployed workers received benefits.

By the time this recession began, 20% of the Canadian work force was in precarious forms of employment: part-time, temporary, and self-employment. Double that figure for women.

Only 38% of Canadian workers now have a workplace pension plan. Many company pensions have gone (or are on the verge of going) bankrupt. And Canadians of pre-retirement age (55-64) have an average of just $55,000 in RRSPs — enough to fund a pension of $250 a month.

One neo-con counter-argument to this analysis is that all advanced industrialized countries in this globalization era have experienced similar trends and outcomes, and so, it is claimed, they were unavoidable. The reality is otherwise.

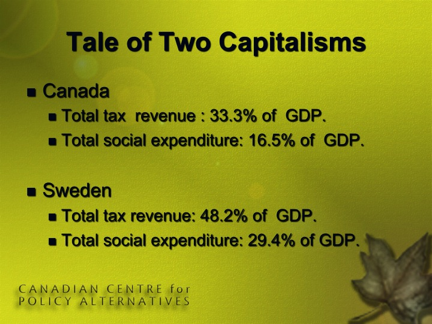

Although possessing common features, modern capitalism is not a one-size-fits-all proposition. Different varieties or models of capitalism are practised by different countries, and they have responded differently to the pressures of globalization. Canada, like the U.S. and Britain, fits the neo-con model: the most unequal, the most deregulated, and with the smallest public sector.

In contrast, the Nordic model, represented here by Sweden, has a very large public sector, a comprehensive social security system, and relatively low income inequality. Policy-makers there retain major elements of Keynesian approaches to macro-economic management.

Let us compare these two kinds of capitalism and their evolution over the last 30 years.

TABLE 2: A Tale of Two Capitalisms

Overall tax levels in a democratic society are (or should be) the result of political choices, reflecting preferences about which goods and services should be provided by the public sector, and which should be provided by the private sector through the market.

If Canadian taxes were at the same level as Sweden’s, our governments would have $228 billion more revenue per year to spend. And if our spending on social programs was the same as it is in Sweden, we would be spending $198 billion more on them per year.

For most Swedes, paying taxes is a benefit, not a burden. Most Canadians think taxes are too high. The very term “tax burden” has become embedded in the popular Canadian lexicon.

In Sweden, most people trust government to manage taxes well. This is no longer true for Canada. The neo-con project has succeeded in greatly eroding public confidence in government. It has lowered people’s expectations of what government can or should do. It has bred apathy and cynicism. It has reduced citizen engagement in the political process, and increased public receptiveness to the neo-con message of private gain over public good.

Sweden spends substantially more than Canada on public education, public pensions, and labour market training. It has the second lowest level of inequality in the industrialized world (GINI Index) while Canada is ranked much lower in the 18th spot. Canada does fare a little better on seniors’ poverty, but, to our great shame, child poverty in this country is almost four times higher than it is in Sweden.

Average unemployment in Sweden was substantially lower than Canadian unemployment over the last three decades — 5.2% compared to 8.7%. While Canada’s unionization rate has fallen to 28.4%, Sweden’s work force remains very highly unionized at 78% -- disproving the claim that unions impede job creation. And it has a comprehensive unemployment insurance system, which covers (to varying degrees) virtually all unemployed workers. Nearly half of the 1.5 million Canadians now unemployed are denied the unemployment insurance benefits they so desperately need to help them through this terrible time – even though they have paid for this insurance with the UI premiums deducted from their pay-cheques.

Neo-cons typically respond that the Swedish “nanny state” stifles the economic dynamism of the free market. So how do the two countries stack up on the key economic performance indicators over the last 30 years?

Swedish labour productivity growth (output per hour worked) has outpaced Canada’s by a wide margin. Sweden has a 50% higher level of R&D spending. Sweden ranked 4th on the World Economic Forum’s global competitiveness ranking, compared to Canada’s 9th place. Sweden also had a significantly lower government debt/GDP ratio than Canada. Only on inflation did Canada beat out Sweden -- by about one percentage point per year over the 30-year period.

* * *

Neo-con economics, the dominant force in Canadian policy-making for the last three decades, is responsible for the disastrous reversal of the historic social and economic achievements of the post-war era.

The generation of policy-makers that gave us the unprecedented “Golden Age” was replaced by the baby-boom generation who took these middle-class achievements for granted and presided over their reversal.

To be sure, important elements remain. However, stable jobs, rising incomes, and confidence in the future have been replaced by stagnant incomes, more job insecurity, diminished social protections, lower expectations of government, and rising anxiety about the future.

The growing inequality has huge adverse effects on society at large: on physical and mental health, on social mobility, on violence and incarceration, on productivity. It is corroding our sense of social solidarity. The sense that we are all in this together is being replaced by growing fear and distrust of others — of immigrants, visible minorities, even the poor.

Those at the very top, who have done so well, are distancing themselves from the rest of us, opting for private schools and private health care, increasingly living in communities protected by private security guards.

Post-secondary education, the path to upward mobility, has become a lot less affordable than for the preceding generation. And for many who do get a university education (incurring large debts in the process), well-paying middle-class jobs are harder to come by.

Medicare no longer covers what it did before. Prescription drug costs have been rising rapidly. Proper home- and long-term care are increasingly out of reach.

Two years into the Great Recession, with the neo-con system in shambles, the question is: will this be a pause in the process of continued tearing-down? Or will it be a turning point marked by renewed building of the kind of social and economic security for all envisioned in the UN Declaration of Human Rights?

As the Swedish example shows, none of this aspiration for a just society is beyond our reach. What is required from us as a society is a sustained act of political will.

We owe it to our children.

-----

(Bruce Campbell is Executive Director of the CCPA.)

Sources and Resources

Broadbent, Ed: The Rise and Fall of Economic and Social Rights

Hennessy, Trish: Growing Gap, Growing Concerns - Poll (2006)

Mackenzie, Hugh and Richard Shillington: Canada’s Quiet Bargain: The Benefits of Public Spending. (2009)

Lee, Marc: Eroding Tax Fairness: Tax Incidence in Canada 1990-2005. (2006)

Mackenzie, Hugh: A Soft Landing: Recession and Canada’s 100 Highest Paid CEOs.(2010)

© 2010 Canadian Centre for Policy Alternatives

| < Prev | Next > |

|---|