Tuesday, 02 June 2009 17:58

Ian Rae Macdonald

... about The Economy

inconvenient facts

"The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. Banking was conceived in iniquity and born in sin. Bankers own the earth. Take it away from them, but leave them the power to create money and control credit, and with the flick of a pen, they will create enough money to buy it back again. Take this great power away from the bankers and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a better and happier world to live in. But if you want to continue the slaves of bankers and pay the cost of your own slavery, let them continue to create money and to control credit." "The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. Banking was conceived in iniquity and born in sin. Bankers own the earth. Take it away from them, but leave them the power to create money and control credit, and with the flick of a pen, they will create enough money to buy it back again. Take this great power away from the bankers and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a better and happier world to live in. But if you want to continue the slaves of bankers and pay the cost of your own slavery, let them continue to create money and to control credit."

Read more...

Monday, 01 June 2009 16:16

by Stephen Lendman

... about The Economy

Editor's Note: This article was first published on this site June 1, 2009

A Review of Daniel Estulin's book

For over 14 years, Daniel Estulin has investigated and researched the Bilderberg Group's far-reaching influence on business and finance, global politics, war and peace, and control of the world's resources and its money. For over 14 years, Daniel Estulin has investigated and researched the Bilderberg Group's far-reaching influence on business and finance, global politics, war and peace, and control of the world's resources and its money.

Read more...

Monday, 01 June 2009 14:13

by Greg Palast

... about The Economy

Screw the autoworkers.

They may be crying about General Motors' bankruptcy today. But dumping 40,000 of the last 60,000 union jobs into a mass grave won't spoil Jamie Dimon's day. They may be crying about General Motors' bankruptcy today. But dumping 40,000 of the last 60,000 union jobs into a mass grave won't spoil Jamie Dimon's day.

Dimon is the CEO of JP Morgan Chase bank. While GM workers are losing their retirement health benefits, their jobs, their life savings; while shareholders are getting zilch and many creditors getting hosed, a few privileged GM lenders - led by Morgan and Citibank - expect to get back 100% of their loans to GM, a stunning $6 billion.

The way these banks are getting their $6 billion bonanza is stone cold illegal.

I smell a rat.

Read more...

Friday, 29 May 2009 19:02

by Stephen Lendman

... about The Economy

Wall Street's mantra is that markets move randomly and reflect the collective wisdom of investors. The truth is quite opposite. The government's visible hand and insiders control markets and manipulate them up or down for profit - all of them, including stocks, bonds, commodities and currencies. Wall Street's mantra is that markets move randomly and reflect the collective wisdom of investors. The truth is quite opposite. The government's visible hand and insiders control markets and manipulate them up or down for profit - all of them, including stocks, bonds, commodities and currencies.

It's financial fraud or what former high-level Wall Street insider and former Assistant HUD Secretary Catherine Austin Fitts calls "pump and dump," defined as "artificially inflating the price of a stock or other security through promotion, in order to sell at the inflated price," then profit more on the downside by short-selling. "This practice is illegal under securities law, yet it is particularly common," and in today's volatile markets likely ongoing daily.

Global Research

Read more...

Thursday, 28 May 2009 20:29

by Mike Whitney

... about The Economy

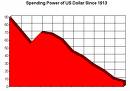

Collapsing home prices and credit markets continue to put downward pressure on consumer spending, forcing the Federal Reserve to take even more radical action to revive the economy. Last week, Fed chief Ben Bernanke raised the prospect of further monetizing the debt by purchasing more than the $1.75 trillion of Treasuries and mortgage-backed securities (MBS) already committed. The announcement sent shock-waves through the currency markets where skittish traders have joined doomsayers in predicting tough times ahead for the dollar. Foreign central banks have been gobbling up US debt at an impressive pace, adding another $60 billion in the last three weeks alone. That's more than enough to cover the current account deficit and put the greenback on solid ground for the time-being. But with fiscal deficits ballooning to $3 trillion in the next year alone, dwindling foreign investment won't be enough to keep the dollar afloat. Bernanke will be forced to either raise interest rates or let the dollar fall hard. Collapsing home prices and credit markets continue to put downward pressure on consumer spending, forcing the Federal Reserve to take even more radical action to revive the economy. Last week, Fed chief Ben Bernanke raised the prospect of further monetizing the debt by purchasing more than the $1.75 trillion of Treasuries and mortgage-backed securities (MBS) already committed. The announcement sent shock-waves through the currency markets where skittish traders have joined doomsayers in predicting tough times ahead for the dollar. Foreign central banks have been gobbling up US debt at an impressive pace, adding another $60 billion in the last three weeks alone. That's more than enough to cover the current account deficit and put the greenback on solid ground for the time-being. But with fiscal deficits ballooning to $3 trillion in the next year alone, dwindling foreign investment won't be enough to keep the dollar afloat. Bernanke will be forced to either raise interest rates or let the dollar fall hard.

Read more...

Wednesday, 27 May 2009 21:14

by Stephen Lendman

... about The Economy

Some of the best ideas are often the simplest. When applied to the global economic crisis, the solution is easier than imagined. What's hard, in fact a Gordian Knot, is the political will to embrace it. But even matters that great can be solved by a bold stoke, and according to legend, Alexander the Great's "Alexandrian solution" was achieved with one stroke of his sword, cutting the Knot in half. Applied to the global economic crisis, it means addressing it with effective policies, not ones wrecking America and other troubled nations worldwide. Some of the best ideas are often the simplest. When applied to the global economic crisis, the solution is easier than imagined. What's hard, in fact a Gordian Knot, is the political will to embrace it. But even matters that great can be solved by a bold stoke, and according to legend, Alexander the Great's "Alexandrian solution" was achieved with one stroke of his sword, cutting the Knot in half. Applied to the global economic crisis, it means addressing it with effective policies, not ones wrecking America and other troubled nations worldwide.

Global Research

Read more...

Wednesday, 27 May 2009 20:53

by Ellen Brown

... about The Economy

“I understand that these cuts are very painful and they affect real lives. This is the harsh reality and the reality that we face. Sacramento is not Washington – we cannot print our own money. We can only spend what we have.” Governor Arnold Schwarzenegger quoted in Time, May 22, 2009

Christmas comes early, Governor. You CAN print your own money. Fiscally solvent North Dakota is doing it . . . and so can California. Now!!!

Read more...

Tuesday, 26 May 2009 20:15

by Andrew G. Marshall

... about The Economy

From May 14-17, the global elite met in secret in Greece for the yearly Bilderberg conference, amid scattered and limited global media attention. Roughly 130 of the world’s most powerful individuals came together to discuss the pressing issues of today, and to chart a course for the next year. The main topic of discussion at this years meeting was the global financial crisis, which is no surprise, considering the list of conference attendees includes many of the primary architects of the crisis, as well as those poised to “solve” it. From May 14-17, the global elite met in secret in Greece for the yearly Bilderberg conference, amid scattered and limited global media attention. Roughly 130 of the world’s most powerful individuals came together to discuss the pressing issues of today, and to chart a course for the next year. The main topic of discussion at this years meeting was the global financial crisis, which is no surprise, considering the list of conference attendees includes many of the primary architects of the crisis, as well as those poised to “solve” it.

Global Research

Read more...

Wednesday, 20 May 2009 20:56

by John Bellamy Foster and Fred Magdoff

... about The Economy

Back To The Real Economy

Monthly Review

But, you may ask, won’t the powers that be step into the breach again and abort the crisis before it gets a chance to run its course? Yes, certainly. That, by now, is standard operating procedure, and it cannot be excluded that it will succeed in the same ambiguous sense that it did after the 1987 stock market crash. If so, we will have the whole process to go through again on a more elevated and more precarious level. But sooner or later, next time or further down the road, it will not succeed… We will then be in a new situation as unprecedented as the conditions from which it will have emerged. But, you may ask, won’t the powers that be step into the breach again and abort the crisis before it gets a chance to run its course? Yes, certainly. That, by now, is standard operating procedure, and it cannot be excluded that it will succeed in the same ambiguous sense that it did after the 1987 stock market crash. If so, we will have the whole process to go through again on a more elevated and more precarious level. But sooner or later, next time or further down the road, it will not succeed… We will then be in a new situation as unprecedented as the conditions from which it will have emerged.

—Harry Magdoff and Paul Sweezy (1988) 1

Read more...

Saturday, 09 May 2009 19:32

by Richard C. Cook

... about The Economy

The System is Designed to Exert Total Control Over the Lives of Individuals

The Report from Iron Mountain Revisited

What impresses me in the current financial crisis is the near-total failure of so-called progressives to appreciate the magnitude of what is going on or the level of intelligence behind it. How many will say, for instance, that the crash was deliberately engineered by the creation, then destruction, of the investment bubbles of the last decade? What impresses me in the current financial crisis is the near-total failure of so-called progressives to appreciate the magnitude of what is going on or the level of intelligence behind it. How many will say, for instance, that the crash was deliberately engineered by the creation, then destruction, of the investment bubbles of the last decade?

When the financial system creates bubbles it drives up the cost of assets far beyond their true value in producing or storing wealth. When the bubbles burst the value of the assets plummets. Those with ready cash then buy them up on the cheap. When the dust settles more wealth has been concentrated in fewer hands. The rich get richer, and ordinary people are left in a deeper condition of indebtedness, poverty, and pressure to perform to the liking of the financial masters.

Read more...

|

Tuesday, 05 May 2009 19:27

by Dr. Jack Rasmus

... about The Economy

Calls for nationalizing the banking industry have been bubbling since at least last September 2008, when the current Banking Panic began in the wake of the Lehman Brothers bank collapse, the initial AIG bailout, and the quick absorption of Merrill Lynch-Wachovia-Washington Mutual banks by their larger competitors, Bank of America, Wells Fargo, and JP Morgan Chase. Calls for nationalizing the banking industry have been bubbling since at least last September 2008, when the current Banking Panic began in the wake of the Lehman Brothers bank collapse, the initial AIG bailout, and the quick absorption of Merrill Lynch-Wachovia-Washington Mutual banks by their larger competitors, Bank of America, Wells Fargo, and JP Morgan Chase.

Read more...

Saturday, 02 May 2009 05:56

by Brent Budowsky

... about The Economy

The Hill

This week America witnessed Black Thursday for workers and families as the Senate defeated a bankruptcy bill that would have protected distressed homeowners and the House passed a bill that encourages and guarantees banks will continue abuses the bill pretends to remedy for a full year. This week America witnessed Black Thursday for workers and families as the Senate defeated a bankruptcy bill that would have protected distressed homeowners and the House passed a bill that encourages and guarantees banks will continue abuses the bill pretends to remedy for a full year.

Politically and financially, Americans will look back on these years, and judge what happens when a Democratic president and Democratic Congress use the government as an instrument of reform, change and problem-solving. To state my conclusion at the outset, I do not believe Treasury Secretary Timothy Geithner has carried this mantle well and what I see in current policy is little more than a gigantic transfer of wealth from taxpayers to banks, which is being abused and misused by most banks.

Read more...

Tuesday, 28 April 2009 15:47

by Richard C. Cook

... about The Economy

Do you remember the TV cartoon show “Pinky and The Brain”? Do you remember the TV cartoon show “Pinky and The Brain”?

The show was about two white mice. Pinky was a gangly nutcase who talked like the Walt Disney character Goofy, with a similar personality. The Brain was this little conniving, scowling kind of guy who woke up every morning with his latest plan to take over the world.

Read more...

Friday, 24 April 2009 21:55

by Steve da Silva

... about The Economy

The Insured Mortgage Purchase Program (IMPP) and the Extraordinary Financing Framework (EFF) is to the Canadians what the Troubled Asset Relief Program (TARP) is to Americans: A cover for hundreds of billions of dollars – trillions in the U.S. – of public funds being dumped into the coffers of parasitic monopoly financial interests.

If you’re still scratching your head with bewilderment trying to understand how the “free-market” Conservatives could make an overnight about-face into Keynesians – from promising budget surpluses during the October 2008 Federal election to giving us unforeseen budget deficits in the 2009 Budget – then you’ve bought into the terms of a “public” debate that is intended to confuse and conceal what’s really going on. The Conservatives have not broke with old ideas as a last-ditch attempt to hold onto power in Parliament, as many are saying. Rest assured that the Conservatives have been and remain the most shameless representatives of monopoly capitalist interests in this country. Over the last three months, the Conservatives – taking the lead from Bush and Obama presidencies in United States and most other imperialist countries – have begun to implement one of the largest transfers of public wealth in Canadian history, channeling untold amounts of public funds into the coffers of the banks and other monopoly financial interests, accounting for at least $275 billion in “bailout” money.

Read more...

Friday, 24 April 2009 21:05

by Steven Lesh

... about The Economy

The privilege of supplying the world’s reserve currency, the money nations use to conduct business beyond their borders, is a source of power to the nation that possesses it more valuable than the most powerful military. Since virtually all money is created ‘out of thin air’ by entries in bank ledgers, the nation supplying the world’s reserve currency has the power to create enough money to buy the world. Working in conjunction with its banks, a nation supplying the reserve currency can conquer and control vastly more of the world’s wealth than it could hope to with military force. It is this power, the ‘dollar standard’ foundation of the international monetary system, the US government in conjunction with Wall Street, US money-center (big) banks and compliant central banks around the world are working so desperately to sustain. Until this is recognized and resisted, not just in the US but around the world, there is little hope for a stable world economy or for a more just international economic order. The privilege of supplying the world’s reserve currency, the money nations use to conduct business beyond their borders, is a source of power to the nation that possesses it more valuable than the most powerful military. Since virtually all money is created ‘out of thin air’ by entries in bank ledgers, the nation supplying the world’s reserve currency has the power to create enough money to buy the world. Working in conjunction with its banks, a nation supplying the reserve currency can conquer and control vastly more of the world’s wealth than it could hope to with military force. It is this power, the ‘dollar standard’ foundation of the international monetary system, the US government in conjunction with Wall Street, US money-center (big) banks and compliant central banks around the world are working so desperately to sustain. Until this is recognized and resisted, not just in the US but around the world, there is little hope for a stable world economy or for a more just international economic order.

Read more...

Wednesday, 22 April 2009 05:29

by Mike Whitney

... about The Economy

Bigger Crash Ahead. Huge "shadow inventory"

Global Research Global Research

Due to the lifting of the foreclosure moratorium at the end of March, the downward slide in housing is gaining speed. The moratorium was initiated in January to give Obama's anti-foreclosure program---which is a combination of mortgage modifications and refinancing---a chance to succeed. The goal of the plan was to keep up to 9 million struggling homeowners in their homes, but it's clear now that the program will fall well-short of its objective.

Read more...

Monday, 20 April 2009 14:33

by Jason Hommel

... about The Economy

"The scope of fraud in the silver market alone is staggering"

Let's review the fundamentals of gold and silver. Let's review the fundamentals of gold and silver.

The world gold mines produces 2500 tonnes per year, which is about 80 million ounces. With gold at $867, that's $69 billion worth of gold mined each year. That's a tiny market in the scale of world finance, where the USA has $14,000 billion in the US banking system at risk, and has added $11,000 billion of commitments in bail outs, and continues to issue $800 billion bail outs with increasing regularity, with a total budget exceeding $3000 billion, and a budget deficit approaching $1500 billion.

Read more...

Monday, 20 April 2009 14:14

by Ellen Brown

... about The Economy

Secretive Plans for the Issuing of a Global Currency

Do we really want the Bank for International Settlements (BIS) issuing our global currency

In an April 7 article in The London Telegraph titled “The G20 Moves the World a Step Closer to

a Global Currency,” Ambrose Evans-Pritchard wrote:

“A single clause in Point 19 of the communiqué issued by the G20 leaders amounts to revolution in the global financial order.

Read more...

Monday, 13 April 2009 17:19

by Robert Weissman

... about The Economy

Multinational Monitor

What a year for corporate criminality and malfeasance!

As we compiled the Multinational Monitor list of the 10 Worst Corporations of 2008, it would have been easy to restrict the awardees to Wall Street firms. But the rest of the corporate sector was not on good behavior during 2008 either, and we didn't want them to escape justified scrutiny. So, in keeping with our tradition of highlighting diverse forms of corporate wrongdoing, we included only one financial company on the 10 Worst list. Here, presented in alphabetical order, are the 10 Worst Corporations of 2008.

Read more...

Friday, 03 April 2009 21:14

Rolling Stone

... about The Economy

Meet the bankers and brokers responsible for the financial crisis - and the officials who let them get away with it

Rolling Stone

Read more...

Friday, 03 April 2009 20:40

by Ralph Nader

... about The Economy

The Nader Page The Nader Page

Why is it that well regarded people working the fields of corporate power and performance who repeatedly predicted the Wall Street bubble and its bursting receive so little media and attention?

Read more...

Friday, 03 April 2009 19:20

By Ambrose Evans-Pritchard

... about The Economy

The world is a step closer to a global currency, backed by a global central bank, running monetary policy for all humanity.

Telegraph

A single clause in Point 19 of the communiqué issued by the G20 leaders amounts to revolution in the global financial order. A single clause in Point 19 of the communiqué issued by the G20 leaders amounts to revolution in the global financial order.

"We have agreed to support a general SDR allocation which will inject $250bn (£170bn) into the world economy and increase global liquidity," it said. SDRs are Special Drawing Rights, a synthetic paper currency issued by the International Monetary Fund that has lain dormant for half a century.

Read more...

Thursday, 02 April 2009 21:19

Quotes

... about The Economy

"Conspiracy Theory" or just inconvenient facts?

"The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. Banking was conceived in iniquity and born in sin. Bankers own the earth. Take it away from them, but leave them the power to create money and control credit, and with the flick of a pen, they will create enough money to buy it back again. Take this great power away from the bankers and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a better and happier world to live in. But if you want to continue the slaves of bankers and pay the cost of your own slavery, let them continue to create money and to control credit."

Sir Josiah Stamp, Director and President of the Bank of England during the 1920's

"Today, America would be outraged if U.N. troops entered Los Angeles to restore order [referring to the 1991 LA Riot]. Tomorrow they will be grateful! This is especially true if they were told that there were an outside threat from beyond [i.e., an "extraterrestrial" invasion], whether real or promulgated, that threatened our very existence. It is then that all peoples of the world will plead to deliver them from this evil. The one thing every man fears is the unknown. When presented with this scenario, individual rights will be willingly relinquished for the guarantee of their well-being granted to them by the World Government."

Dr. Henry Kissinger, Bilderberger Conference, Evians, France, 1991

"I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the civilized world. No longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and duress of a small group of dominant men."

President Woodrow Wilson (who introduced the Federal Reserve act which allowed the privately owned Federal Reserve to begin in 1913)

"Since I entered politics, I have chiefly had men's views confided to me privately. Some of the biggest men in the United States, in the Field of commerce and manufacture, are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they better not speak above their breath when they speak in condemnation of it."

Woodrow Wilson,The New Freedom (1913)

"The real menace of our republic is this invisible government which like a giant octopus sprawls its slimy length over city, state and nation. Like the octopus of real life, it operates under cover of a self created screen....At the head of this octopus are the Rockefeller Standard Oil interests and a small group of powerful banking houses generally referred to as international bankers. The little coterie of powerful international bankers virtually run the United States government for their own selfish purposes. They practically control both political parties."

New York City Mayor John F. Hylan, 1922

"We are at present working discreetly with all our might to wrest this mysterious force called sovereignty out of the clutches of the local nation states of the world. All the time we are denying with our lips what we are doing with our hands."

Professor Arnold Toynbee, in a June 1931 speech before the Institute for the Study of International Affairs in Copenhagen.

"The question was how should we maneuver them [Japan] into firing the first shot... it was desirable to make sure the Japanese be the ones to do this so that there should remain no doubt as to who were the aggressors."

Henry Stimson, US Secretary of War prior to WWII, Nov. 25, 1941

"For a long time I felt that FDR had developed many thoughts and ideas that were his own to benefit this country, the United States. But, he didn't. Most of his thoughts, his political ammunition, as it were, were carefully manufactured for him in advanced by the Council on Foreign Relations - One World Money group. Brilliantly, with great gusto, like a fine piece of artillery, he exploded that prepared "ammunition" in the middle of an unsuspecting target, the American people, and thus paid off and returned his internationalist political support.

"The UN is but a long-range, international banking apparatus clearly set up for financial and economic profit by a small group of powerful One-World revolutionaries, hungry for profit and power.

"The depression was the calculated 'shearing' of the public by the World Money powers, triggered by the planned sudden shortage of supply of call money in the New York money market....The One World Government leaders and their ever close bankers have now acquired full control of the money and credit machinery of the U.S. via the creation of the privately owned Federal Reserve Bank."

Curtis Dall, FDR's son-in-law as quoted in his book, My Exploited Father-in-Law

"Very soon, every American will be required to register their biological property (that's you and your children) in a national system designed to keep track of the people and that will operate under the ancient system of pledging. By such methodology, we can compel people to submit to our agenda, which will affect our security as a charge back for our fiat paper currency.

Every American will be forced to register or suffer being able to work and earn a living. They will be our chattels (property) and we will hold the security interest over them forever, by operation of the law merchant under the scheme of secured transactions. Americans, by unknowingly or unwittingly delivering the bills of lading (Birth Certificate) to us will be rendered bankrupt and insolvent, secured by their pledges.

They will be stripped of their rights and given a commercial value designed to make us a profit and they will be none the wiser, for not one man in a million could ever figure our plans and, if by accident one or two should figure it out, we have in our arsenal plausible deniability. After all, this is the only logical way to fund government, by floating liens and debts to the registrants in the form of benefits and privileges.

This will inevitably reap us huge profits beyond our wildest expectations and leave every American a contributor to this fraud, which we will call "Social Insurance". Without realizing it, every American will unknowingly be our servant, however begrudgingly. The people will become helpless and without any hope for their redemption and we will employ the high office (presidency) of our dummy corporation (USA) to foment this plan against America."

Colonel Edward Mandell House is attributed with giving a very detailed outline of the plans to be implemented to enslave the American people. He stated, in a private meeting with Woodrow Wilson (President 1913 - 1921)

"Fifty men have run America, and that's a high figure."

Joseph Kennedy, father of JFK, in the July 26th, 1936 issue of The New York Times.

"The Trilateral Commission is intended to be the vehicle for multinational consolidation of the commercial and banking interests by seizing control of the political government of the United States. The Trilateral Commission represents a skillful, coordinated effort to seize control and consolidate the four centers of power political, monetary, intellectual and ecclesiastical. What the Trilateral Commission intends is to create a worldwide economic power superior to the political governments of the nationstates involved. As managers and creators of the system, they will rule the future."

U.S. Senator Barry Goldwater in his 1964 book: With No Apologies

"The Council on Foreign Relations is 'the establishment'. Not only does it have influence and power in key decision-making positions at the highest levels of government to apply pressure from above, but it also announces and uses individuals and groups to bring pressure from below, to justify the high level decisions for converting the U.S. from a sovereign Constitutional Republic into a servile member state of a one-world dictatorship."

Former Congressman John Rarick 1971

"The most powerful clique in these (CFR) groups have one objective in common: they want to bring about the surrender of the sovereignty and the national independence of the U.S. They want to end national boundaries and racial and ethnic loyalties supposedly to increase business and ensure world peace. What they strive for would inevitably lead to dictatorship and loss of freedoms by the people. The CFR was founded for "the purpose of promoting disarmament and submergence of U.S. sovereignty and national independence into an all-powerful one-world government."

Harpers, July 1958

"How fortunate for Leaders' that men do not think."

Adolf Hitler

Monday, 30 March 2009 20:17

by F. William Engdahl

... about The Economy

The Entire Global Financial System is at Risk

When the Solution to the Financial Crisis becomes the Cause

US Treasury Secretary Tim Geithner has unveiled his long-awaited plan to put the US banking system back in order. In doing so, he has refused to tell the ‘dirty little secret’ of the present financial crisis. By refusing to do so, he is trying to save de facto bankrupt US banks that threaten to bring the entire global system down in a new more devastating phase of wealth destruction. US Treasury Secretary Tim Geithner has unveiled his long-awaited plan to put the US banking system back in order. In doing so, he has refused to tell the ‘dirty little secret’ of the present financial crisis. By refusing to do so, he is trying to save de facto bankrupt US banks that threaten to bring the entire global system down in a new more devastating phase of wealth destruction.

Read more...

Monday, 30 March 2009 20:07

by Prof. Michael Hudson

... about The Economy

The "Dollar Glut" is What Finances America's Global Military Build-up

I am traveling in Europe for three weeks to discuss the global financial crisis with government officials, politicians and labor leaders. What is most remarkable is how differently the financial problem is perceived over here. It's like being in another economic universe, not just another continent. I am traveling in Europe for three weeks to discuss the global financial crisis with government officials, politicians and labor leaders. What is most remarkable is how differently the financial problem is perceived over here. It's like being in another economic universe, not just another continent.

Read more...

Monday, 30 March 2009 19:52

by Prof. James Petras

... about The Economy

Regional Wars and the Decline of the US Empire

Part I

Introduction Introduction

All the idols of capitalism over the past three decades crashed. The assumptions and presumptions, paradigm and prognosis of indefinite progress under liberal free market capitalism have been tested and have failed. We are living the end of an entire epoch: Experts everywhere witness the collapse of the US and world financial system, the absence of credit for trade and the lack of financing for investment. A world depression, in which upward of a quarter of the world’s labor force will be unemployed, is looming.

Read more...

Sunday, 29 March 2009 19:59

by Actindependent.org

... about The Economy

As a First Step Towards World Economic Recovery

The Underlying Cause of the Financial Meltdown

Washington DC, March 22 – On the eve of the long-awaited London conference of the G-20 nations, we are rapidly descending into the chaos of a Second World Economic Depression of catastrophic proportions. In the year since the collapse of Bear Stearns, we have moved toward the disintegration of the entire globalized world financial system, based on the residual status of the US dollar as a reserve currency, and expressed through the banking hegemony of London, New York, and the US-UK controlled international lending institutions like the International Monetary fund and the World Bank. Washington DC, March 22 – On the eve of the long-awaited London conference of the G-20 nations, we are rapidly descending into the chaos of a Second World Economic Depression of catastrophic proportions. In the year since the collapse of Bear Stearns, we have moved toward the disintegration of the entire globalized world financial system, based on the residual status of the US dollar as a reserve currency, and expressed through the banking hegemony of London, New York, and the US-UK controlled international lending institutions like the International Monetary fund and the World Bank.

Read more...

Saturday, 28 March 2009 20:32

by Mike Whitney

... about The Economy

The US Treasury's Cash Giveaway Bonanza

There's depressing news this week that the big banks are up to their old shenanigans again. This time they've zeroed in on Geithner's cash giveaway bonanza, the "Public Private Investment Partnership" (PPIP). As expected, Bank of America and Citigroup have angled their way to the front of the herd, thrusting their pig-heads into the public trough and extracting whatever morsels they can find amid a din of gurgling and sucking sounds. Here's the story from the New York Post: There's depressing news this week that the big banks are up to their old shenanigans again. This time they've zeroed in on Geithner's cash giveaway bonanza, the "Public Private Investment Partnership" (PPIP). As expected, Bank of America and Citigroup have angled their way to the front of the herd, thrusting their pig-heads into the public trough and extracting whatever morsels they can find amid a din of gurgling and sucking sounds. Here's the story from the New York Post:

Read more...

Saturday, 28 March 2009 16:42

by Prof. Michael Hudson

... about The Economy

Ben Bernanke’s False Analogy

Global Research

On the March 15 CBS show "60 Minutes", Federal Reserve Chairman Ben Bernanke used a false analogy already popularized by President Obama in his quasi-State of the Union Speech. He likened the financial sector to a house burning down – fair enough, as it is destroying property values, leading to foreclosures, abandonments, stripping (for copper wire and anything else recoverable) and certainly a devastation of value. The problem with this analogy was just where this building was situated, and its relationship to "other houses" (e.g., the rest of the economy). On the March 15 CBS show "60 Minutes", Federal Reserve Chairman Ben Bernanke used a false analogy already popularized by President Obama in his quasi-State of the Union Speech. He likened the financial sector to a house burning down – fair enough, as it is destroying property values, leading to foreclosures, abandonments, stripping (for copper wire and anything else recoverable) and certainly a devastation of value. The problem with this analogy was just where this building was situated, and its relationship to "other houses" (e.g., the rest of the economy).

Read more...

Friday, 20 March 2009 17:41

by Ruth Conniff

... about The Economy

Democrats from Andrew Cuomo to Barney Frank to Barack Obama are demanding that the 418 AIG employees who received bonuses give them back. Sure, it's outrageous that the very people who drove AIG off the cliff, along with a whole lot of other financial firms, walked away with million-dollar bonuses paid with taxpayer bailout money. But as the Wall Street Journal opinion page points out, "Taxpayers have already put up $173 billion, or more than a thousand times the amount of those bonuses, to fund the government's AIG 'rescue.'" Democrats from Andrew Cuomo to Barney Frank to Barack Obama are demanding that the 418 AIG employees who received bonuses give them back. Sure, it's outrageous that the very people who drove AIG off the cliff, along with a whole lot of other financial firms, walked away with million-dollar bonuses paid with taxpayer bailout money. But as the Wall Street Journal opinion page points out, "Taxpayers have already put up $173 billion, or more than a thousand times the amount of those bonuses, to fund the government's AIG 'rescue.'"

Thursday, 19 March 2009 11:56

by João Pedro Stedile

... about The Economy

It's been several months since the crisis of capitalism was unleashed on the international level, with its epicenter in financial capital and the U.S. economy. Now we have more evidence that this crisis will be profound and prolonged, affecting all the peripheral economies -- including Brazil. It's been several months since the crisis of capitalism was unleashed on the international level, with its epicenter in financial capital and the U.S. economy. Now we have more evidence that this crisis will be profound and prolonged, affecting all the peripheral economies -- including Brazil.

Read more...

Tuesday, 17 March 2009 17:14

by Bonnie Faulkner

... about The Economy

Radio Interview with Michel Chossudovsky

Click to listen Click to listen

"America's Fiscal Collapse - Obama's Budget Will Impoverish America"

with economist and author, Michel Chossudovsky

Guns and Butter, KPFA

The administration's 2010 budget will entail the most drastic curtailment in public spending in American history, leading to social havoc and the potential impoverishment of millions of people. Defense spending and bank bailouts will consume all government revenue resulting in fiscal collapse that will lead to the privatization of the state.

Read more...

Wednesday, 11 March 2009 17:54

by Matthias Chang

... about The Economy

How Did It Happen and What are the Ugly Consequences?

The Federal Reserve is bankrupt for all intents and purposes. The same goes for the Bank of England! The Federal Reserve is bankrupt for all intents and purposes. The same goes for the Bank of England!

This article will focus largely on the Fed, because the Fed is the "financial land-mine".

How long can someone who has stepped on a landmine, remain standing – hours, days? Eventually, when he is exhausted and his legs give way, the mine will just explode!

The shadow banking system has not only stepped on the land-mine, it is carrying such a heavy load (trillions of toxic wastes) that sooner or later it will tilt, give way and trigger off the land-mine![1]

Read more...

Monday, 09 March 2009 10:55

by bobswern

... about The Economy

Is A Massive Scandal About To Unfold?

Are facts concerning details of the current Wall Street bailout--past, present and future--about to unfold in a manner which may very well undermine President Obama's first term unless he acts immediately to staunch the damage created, and the damage about to be created, by the missteps of both (former) Bush Treasury Secretary Henry Paulson, as well as (current) Obama Treasury Secretary Tim Geithner? Are facts concerning details of the current Wall Street bailout--past, present and future--about to unfold in a manner which may very well undermine President Obama's first term unless he acts immediately to staunch the damage created, and the damage about to be created, by the missteps of both (former) Bush Treasury Secretary Henry Paulson, as well as (current) Obama Treasury Secretary Tim Geithner?

Sunday, 08 March 2009 22:00

by Matthias Chang

... about The Economy

Guess Who Said It?

When I read the remarks of President Obama and Prime Minister Gordon Brown after their meeting at the Oval Office on March 3, 2009 and the speech of the latter to the Joint Session of Congress on March 4, 2009, I realized that a growing antagonism has emerged between certain factions of the ruling elites in the City of London and in Washington DC. When I read the remarks of President Obama and Prime Minister Gordon Brown after their meeting at the Oval Office on March 3, 2009 and the speech of the latter to the Joint Session of Congress on March 4, 2009, I realized that a growing antagonism has emerged between certain factions of the ruling elites in the City of London and in Washington DC.

The first warning of the acute differences was sounded by President Obama himself and it was most surprising that the mass media paid hardly attention to it.

Read more...

Thursday, 05 March 2009 21:47

by Alistair Barr and Greg Robb

... about The Economy

Pressure to reveal major AIG counterparties grows.

Some suggest fees for firms that got billions of dollars from insurer's bailout

Read more...

Tuesday, 03 March 2009 20:00

by Michel Chossudovsky

... about The Economy

“We will rebuild, we will recover, and the United States of America will emerge stronger" ( President Barack Obama, State of the Union Address 24 Feb 2009)

"Those of us who manage the public's dollars will be held to account—to spend wisely, reform bad habits, and do our business in the light of day—because only then can we restore the vital trust between a people and their government." President Barack Obama, A New Era of Responsibility, the 2010 Budget)

Read more...

Tuesday, 03 March 2009 18:50

by Ellen Brown

... about The Economy

How Cash Starved States can Create their Own Credit

webofdebt.com

“He that will not apply new remedies must expect new evils; for time is the greatest innovator.” Francis Bacon “He that will not apply new remedies must expect new evils; for time is the greatest innovator.” Francis Bacon

On February 19, 2009, California narrowly escaped bankruptcy, when Governor Arnold Schwarzenneger put on his Terminator hat and held the state senate in lockdown mode until they signed a very controversial budget.1 If the vote had failed, the state was going to be reduced to paying its employees in I.O.U.s. California avoided bankruptcy for the time being, but 46 of 50 states are insolvent and could be filing Chapter 9 bankruptcy proceedings in the next two years.2

Read more...

Monday, 02 March 2009 00:11

by David Korten

... about The Economy

The financial crisis has put to rest the myths that our economic institutions are sound and markets work best when deregulated. Our economic institutions have failed, not only financially, but also socially and environmentally. This, combined with the election of a new president with a mandate for change, creates an opportune moment to rethink and redesign. The financial crisis has put to rest the myths that our economic institutions are sound and markets work best when deregulated. Our economic institutions have failed, not only financially, but also socially and environmentally. This, combined with the election of a new president with a mandate for change, creates an opportune moment to rethink and redesign.

Read more...

Saturday, 28 February 2009 21:40

by Richard C. Cook

... about The Economy

The U.S. Economy: Designed to Fail The U.S. Economy: Designed to Fail

Global Research

President Barack Obama showed a great deal of gumption in standing before Congress last night delivering his first speech to the joint assembly. All the trappings of power were on display as members of the House and Senate, the Supreme Court, the Joint Chiefs, the Cabinet, and the VIP guests hugged and waved at each other, radiant in their tailored attire only two nights after the Hollywood stars put on their own show on Oscar night.

Read more...

Monday, 23 February 2009 14:09

by Prof. Michael Hudson

... about The Economy

"Nationalize the banks." "Free Markets." The language of deception. "Nationalize the banks." "Free Markets." The language of deception.

Banking shares began to plunge Friday morning after Senator Dodd, the Connecticut Democrat who is chairman of the banking committee, said in an interview with Bloomberg Television that he was concerned the government might end up nationalizing some lenders "at least for a short time." Several other prominent policy makers – including Alan Greenspan, the former chairman of the Federal Reserve, and Senator Lindsey Graham of South Carolina – have echoed that view recently. (Eric Dash, "Growing Worry on Rescue Takes a Toll on Banks," The New York Times, February 20, 2009)

Read more...

Sunday, 22 February 2009 18:31

by Stephen Lendman

... about The Economy

The more they do, the worse it gets, and world headlines confirm it. Recent ones include: The more they do, the worse it gets, and world headlines confirm it. Recent ones include:

The New York Times, February 17: "After Manhattan's Office Boom, a Hard Fall;"

Washington Post, February 17: "Obama signs $787 billion stimulus bill; Dow Jones industrial average drops nearly 300 points;"

Dow theorist, Richard Russell, called it "one of the damnedest closes I've ever seen," within one point of the November 20 low, and added: "I thought President Obama outlawed torture in the US. Wall Street is not listening."

The next day both the Dow and Transportation averages hit new bear market lows. For Dow theorists like Russell and others, it's confirmation of lower ones to come.

Read more...

Friday, 20 February 2009 15:41

by Gary North

... about The Economy

The banking system of Europe is at the edge of the abyss. A brief story by The Telegraph revealed this last week. The original was almost immediately deleted. A new version was substituted. The banking system of Europe is at the edge of the abyss. A brief story by The Telegraph revealed this last week. The original was almost immediately deleted. A new version was substituted.

You can see the original headline on Google:

European banks may need £16.3 trillion bail-out, EC document warns ...

Read more...

Tuesday, 17 February 2009 19:56

by Prof. Michael Hudson

... about The Economy

The Oligarchs’ Escape Plan – at the Treasury’s Expense The Oligarchs’ Escape Plan – at the Treasury’s Expense

Global Research, February 17, 2009

The financial “wealth creation” game is over. Economies emerged from World War II relatively free of debt, but the 60-year global run-up has run its course. Finance capitalism is in a state of collapse, and marginal palliatives cannot revive it. The U.S. economy cannot “inflate its way out of debt,” because this would collapse the dollar and end its dreams of global empire by forcing foreign countries to go their own way. There is too little manufacturing to make the economy more “competitive,” given its high housing costs, transportation, debt and tax overhead. A quarter to a third of U.S. real estate has fallen into Negative Equity, so no banks will lend to them. The economy has hit a debt wall and is falling into Negative Equity, where it may remain for as far as the eye can see until there is a debt write-down.

Read more...

Wednesday, 11 February 2009 20:22

by Michael Hudson

... about The Economy

The Financial Recovery Plan from Hell The Financial Recovery Plan from Hell

Martin Wolf started off his Financial Times column today (February 11) with the bold question: “Has Barack Obama’s presidency already failed?” The stock market had a similar opinion, plunging 382 points. Having promised “change,” Mr. Obama is giving us more Clinton-Bush via Robert Rubin’s protégé, Tim Geithner. Tuesday’s $2.5 trillion Financial Stabilization Plan to re-inflate the Bubble Economy is basically an extension of the Bush-Paulson giveaway – yet more Rubinomics for financial insiders in the emerging Wall Street trusts.

Read more...

Saturday, 07 February 2009 23:18

by Tom Eley

... about The Economy

On Wednesday, President Barack Obama announced measures that purport to restrict executive compensation to $500,000 at financial institutions receiving billions in government assistance. The figure does not include stock options, which could be redeemed after financial firms pay back loans from the federal government. Nor does it apply to the original recipients of tens of billions in TARP (Troubled Asset Relief Program) money. On Wednesday, President Barack Obama announced measures that purport to restrict executive compensation to $500,000 at financial institutions receiving billions in government assistance. The figure does not include stock options, which could be redeemed after financial firms pay back loans from the federal government. Nor does it apply to the original recipients of tens of billions in TARP (Troubled Asset Relief Program) money.

The measures are essentially a public relations exercise. Their aim is to provide political cover for a new and even larger Wall Street bailout, which Treasury Secretary Timothy Geithner will unveil next week.

Read more...

Wednesday, 04 February 2009 22:00

by Michel Chossudovsky

... about The Economy

The Great Depression of the 21st Century The Great Depression of the 21st Century

CLICK TO VIEW

Read more...

Monday, 02 February 2009 21:57

by Greg Palast

... about The Economy

gregpalast.com

Republicans are right. President Barack Obama treated them like dirt, didn't give a damn what they thought about his stimulus package, loaded it with a bunch of programs that will last for years and will never leave the budget, is giving away money disguised as "tax refunds," and is sneaking in huge changes in policy, from schools to health care, using the pretext of an economic emergency.

Way to go, Mr. O! Mr. Down-and-Dirty Chicago pol. Street-fightin' man. Covering over his break-you-face power play with a "we're all post-partisan friends" BS.

And it's about time.

Read more...

Monday, 02 February 2009 21:46

by Greg Palast

... about The Economy

Former Merrill Lynch CEO John Thain is a man who can parlay catastrophic business failure into mind-blowing personal enrichment. After reducing the company to worthlessness, he sold the "busted bag of financial feces to Bank of America for $50 BILLION." Then Merrill Lynch lost another $5 billion, but Thain still thought he deserved a $30 million bonus - in addition to his already acquired $35,000 toilet. The guy's got hutzpah. He ought to be named Secretary of the Treasury so he can "con Saudi sheiks and Chinese apparatchiks into lending us another trillion." Former Merrill Lynch CEO John Thain is a man who can parlay catastrophic business failure into mind-blowing personal enrichment. After reducing the company to worthlessness, he sold the "busted bag of financial feces to Bank of America for $50 BILLION." Then Merrill Lynch lost another $5 billion, but Thain still thought he deserved a $30 million bonus - in addition to his already acquired $35,000 toilet. The guy's got hutzpah. He ought to be named Secretary of the Treasury so he can "con Saudi sheiks and Chinese apparatchiks into lending us another trillion."

Read more...

Monday, 02 February 2009 00:25

by by Prof. John McMurtry

... about The Economy

Neo-Liberal Coup or Responsible Government

Global Research

When the U.S. Treasury gave away $700 billion to Wall Street banks with no strings attached in October of 2008, the Obama team gave a green light. A popular insurgence was soon silenced, with public wrath directed instead at the U.S. auto producers (and unions) who followed with a request for $25 billion. The auto companies ended up with a loan of about 1/50th the amount that went to Wall Street as a gift. The subtext message was disturbing. Wall Street firms produce nothing, no-one is required to explain what they are doing with all the public money they received, and no criteria of public benefit are applied.

Read more...

Obama: Trilateral Commission Endgame Obama: Trilateral Commission Endgame

January 30, 2009 By Patrick Wood, Editor, August Review

[Ed. note: For clarity, members of the  Trilateral Commission appear in bold type.] Trilateral Commission appear in bold type.]

As previously noted in Pawns of the Global Elite, Barack Obama was groomed for the presidency by key members of the Trilateral Commission. Most notably, it was Zbigniew Brzezinski, co-founder of the Trilateral Commission with David Rockefeller in 1973, who was Obama's principal foreign policy advisor.

The pre-election attention is reminiscent of Brzezinski's tutoring of Jimmy Carter prior to Carter's landslide election in 1976.

Read more...

Thursday, 29 January 2009 19:57

by Vladimir Putin

... about The Economy

World Economic Forum

Prime Minister Vladimir Putin’s speech at the opening ceremony of the World Economic Forum Davos, Switzerland January 28, 2009 Prime Minister Vladimir Putin’s speech at the opening ceremony of the World Economic Forum Davos, Switzerland January 28, 2009

Good afternoon, colleagues, ladies and gentlemen,

I would like to thank the forum’s organisers for this opportunity to share my thoughts on global economic developments and to share our plans and proposals.

The world is now facing the first truly global economic crisis, which is continuing to develop at an unprecedented pace.

Read more...

Thursday, 22 January 2009 09:52

by F. William Engdahl

... about The Economy

During the end of the 1970’s into the 1980’s British Conservative Prime Minister Margaret Thatcher and the City of London financial interests who backed her, introduced wholesale measures of privatization, state budget cuts, moves against labor and deregulation of the financial markets. She did so in parallel with similar moves in the USA initiated by advisers around President Ronald Reagan. The claim was that hard medicine was needed to curb inflation and that the bloated state bureaucracy was a central problem. During the end of the 1970’s into the 1980’s British Conservative Prime Minister Margaret Thatcher and the City of London financial interests who backed her, introduced wholesale measures of privatization, state budget cuts, moves against labor and deregulation of the financial markets. She did so in parallel with similar moves in the USA initiated by advisers around President Ronald Reagan. The claim was that hard medicine was needed to curb inflation and that the bloated state bureaucracy was a central problem.

Read more...

Wednesday, 21 January 2009 21:02

by Shamus Cooke

... about The Economy

The New York Times recently posed an excellent question: “Why save banks if they won’t lend?” (January 19, 2009) The New York Times recently posed an excellent question: “Why save banks if they won’t lend?” (January 19, 2009)

Before the first $350 billion “installment” of the bailout, we were told that the money was needed to “unfreeze” the credit markets, meaning that banks would again be willing to lend businesses the money they needed to continue doing business. Despite hugely popular opposition, the bailout proceeded, and absolutely nothing changed.

Read more...

Tuesday, 20 January 2009 23:47

Dean Baker Co-Director of the Center for Economic and Policy Research

... about The Economy

For some reason most of the discussion in Washington and the media of the bank bailouts is overlooking their central feature: taxpayer dollars are being used to sustain the income of incredibly rich bankers. The public should be furious over this upward redistribution of income. For some reason most of the discussion in Washington and the media of the bank bailouts is overlooking their central feature: taxpayer dollars are being used to sustain the income of incredibly rich bankers. The public should be furious over this upward redistribution of income.

Read more...

Tuesday, 20 January 2009 23:03

by Michel Chossudovsky

... about The Economy

Where have all the Creditors Gone?... Where have all the Creditors Gone?...

"When Will We Ever Learn?"

Global Research, January 20, 2009

Across the land, an atmosphere of hope and optimism prevails. The Bush regime has gone. A new president is in the White House. While America had its eyes riveted on the live TV broadcast of Barack Obama's presidential inauguration, financial markets were sliding. A major "market correction" had occurred. Removed from the public eye, virtually unnoticed, a new stage of the financial crisis has unfolded.

Read more...

Thursday, 08 January 2009 23:14

by Prof. Peter Dale Scott

... about The Economy

Paulson’s Financial Bailout

It is becoming clear that the bailout measures of late 2008 may have consequences at least as grave for an open society as the response to 9/11 in 2001. Many members of Congress felt coerced into voting against their inclinations, and the normal procedures for orderly consideration of a bill were dispensed with.

Read more...

Wednesday, 07 January 2009 23:36

by Paulo dos Santos

... about The Economy

The financial crisis seemed to come out of the blue, but Paulo dos Santos of the University of London argues that the ground was laid by financial sector privatization, liberalization and deregulation. Far from these trends being confined to the rich world, the World Bank and the IFC have played a key role in pushing these policies throughout emerging markets, exposing them to the fallout of the financial crisis. The financial crisis seemed to come out of the blue, but Paulo dos Santos of the University of London argues that the ground was laid by financial sector privatization, liberalization and deregulation. Far from these trends being confined to the rich world, the World Bank and the IFC have played a key role in pushing these policies throughout emerging markets, exposing them to the fallout of the financial crisis.

Read more...

Monday, 05 January 2009 22:57

by Ann Robertson

... about The Economy

Cracks in the Foundation Cracks in the Foundation

The collective consciousness of the U.S. working class is on the brink of a profound transformation. We grew up being told that capitalism was the best of all possible systems, with apparent confirmation being supplied by the fall of the Soviet Union. But we are now entering a new reality that has the potential to overturn all the old, established assumptions perhaps, in the final analysis, even to overturn capitalism itself.

Read more...

Sunday, 04 January 2009 10:58

by Ellen Brown

... about The Economy

Borrowing from Peter to Pay Paul Borrowing from Peter to Pay Paul

Cartoon in the New Yorker: A gun-toting man with large dark glasses, large hat pulled down, stands in front of a bank teller, who is reading a demand note. It says, “Give me all the money in my account.”

Read more...

|

|

"The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. Banking was conceived in iniquity and born in sin. Bankers own the earth. Take it away from them, but leave them the power to create money and control credit, and with the flick of a pen, they will create enough money to buy it back again. Take this great power away from the bankers and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a better and happier world to live in. But if you want to continue the slaves of bankers and pay the cost of your own slavery, let them continue to create money and to control credit."

"The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. Banking was conceived in iniquity and born in sin. Bankers own the earth. Take it away from them, but leave them the power to create money and control credit, and with the flick of a pen, they will create enough money to buy it back again. Take this great power away from the bankers and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a better and happier world to live in. But if you want to continue the slaves of bankers and pay the cost of your own slavery, let them continue to create money and to control credit."

about the Economy

about the Economy

O

O

SAN FRANCISCO (MarketWatch) -- Calls increased Tuesday to reveal the financial institutions that got almost $40 billion in collateral from American International Group shortly after the government first bailed out the insurer last year.

SAN FRANCISCO (MarketWatch) -- Calls increased Tuesday to reveal the financial institutions that got almost $40 billion in collateral from American International Group shortly after the government first bailed out the insurer last year.

Trilateral Commission

Trilateral Commission

Cracks in the Foundation

Cracks in the Foundation Borrowing from Peter to Pay Paul

Borrowing from Peter to Pay Paul