Saturday, 19 November 2011 07:37

by Ellen Brown

... about The Economy

It

is no great surprise that with only days to go, the congressional “super

committee,” given the herculean task of carving an additional $1.2 trillion out

of the federal budget, has failed to reach agreement. Why should six Republicans and six Democrats

with diametrically opposed views agree in a few weeks, when Congress couldn’t

shake hands on it after months of wrangling, despite the guillotine blade of a

federal default hanging over their heads?

Whether the super committee reaches agreement or not, however, the

deficit hawks win. If they agree, either

$1.2 trillion gets cut from the budget or taxes go up by that amount; and the

committee co-chair has categorically stated taxes are not going up, so that means

the budget will be cut. If agreement is

not reached, $1.2 trillion in cuts automatically kick in, split evenly between

domestic and military spending. Either

way, the economy will wind up with $1.2 trillion less in the way purchasing

power. The result will be to reduce

demand, kill jobs, and put more people on the streets.

For the deficit hawks, however, it all seems to be going according to

plan. The super committee is

characterized as an emergency measure that was rushed through to avoid an

arbitrarily imposed August deadline for freezing the debt ceiling, but it has

actually been in the works for years. In

2009, it was called the “Bipartisan Task Force

for Responsible Fiscal Action”. That plan died when its Senate sponsors,

Judd Gregg and Kent Conrad, failed to secure 60 votes for passage in the

Senate. The Gregg-Conrad bill was

criticized as railroading through legislation that would unconstitutionally

slash domestic services without congressional debate, but its task force would

actually have been LESS

autocratic than the super committee, which has sweeping powers and needs

only a simple majority among its 12 members to prevail.

What has been forced out of the debate is whether cutting the budget

is a good idea at all. The Peter

Peterson Foundation, which has been pushing “austerity” for years, has finally

gotten its way. Hedge fund magnate Peter G. Peterson

was Chairman of the Council on Foreign Relations until 2007 and head of the New

York Federal Reserve between 2000 and 2004. He made his fortune with the controversial

Blackstone Group, which he co-founded and chaired for many years. The Peter Peterson Foundation was established

in 2008 with a $1 billion endowment to raise public awareness about

U.S.

fiscal-sustainability issues related to federal deficits, entitlement programs,

and tax policies. The money was used to

spearhead a massive campaign to reduce the runaway federal debt. Hysteria over the debt then prompted Tea Party

newbies in Congress to hold a gun to Congress’ head by arbitrarily capping the

debt.

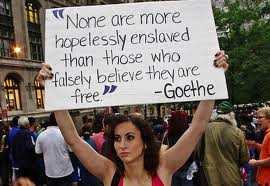

In

the campaign to educate us to the debt’s perils, we were repeatedly warned that

when foreign lenders decided to pull the plug, the

U.S. would

have to declare bankruptcy; that we were mortgaging our grandchildren’s futures

and selling them into debt-slavery; and that all this was the fault of the

citizenry for borrowing and spending too much.

The American people, who are already suffering massive unemployment and

cutbacks in government services, would have to sacrifice more and pay the piper

more, just as in those debt-strapped countries forced into austerity measures by

the IMF.

The fear-mongering, however, is a red herring. A sovereign nation can always find the money

to pay debts owed in its own currency. The Federal Reserve can buy the debt itself –

just as it has been doing. That

alternative would effectively eliminate the problem of interest, since the Fed

returns its profits to the government after deducting its costs.

Alternatively, Congress could reclaim the power to issue money from

the banks and fund its budget directly. The

U.S. could

pay its bills using debt-free U.S. Notes or Greenbacks, just as President

Lincoln did to avoid a crippling debt during the Civil War. Congress could do this without changing any

laws. Congress is empowered to “coin money,” and the Constitution sets no limit

on the face amount of the coins. It

could issue a few one-trillion dollar coins, deposit them in an account, and

start writing checks.

Neither option need inflate prices.

As long as the money is used to purchase goods and services, the result

will simply be to increase demand, increasing production. Prices will not increase until the economy

reaches full employment, and at that point any excess in the money supply can be

taxed back to the government, keeping prices stable.

The key to all this is that our debt is owed in our own currency –

U.S. dollars. Our government has the

power to fix its solvency problems itself, by simply issuing the money it needs

to pay off or refinance its debt. The

U.S. federal

debt has been carried on the books since 1835.

It has NEVER been paid off during that time but just continues to

grow. This has not hurt the economy,

which for most of that period has been among the most vibrant in the world. The federal debt IS the money supply. All of our money except coins is created as

bank debt. Historically,

when the deficit has been reduced, the money supply has been reduced along with

it, throwing the economy into recession.

The real problem with a growing federal debt is the interest on it,

which WILL become an insurmountable burden if allowed to grow

exponentially. Interest

paid on the federal debt in 2010 was $414 billion, or about one-half of

personal income tax receipts. That’s

about as high as we dare let it go. But

this problem can be eliminated either by funding the debt through the nation’s

own central bank, effectively interest-free; or by the Treasury issuing the

money outright, interest-free.

The burgeoning debt has been blamed on reckless government and

consumer spending; but the debt crisis was created, not by a social safety net

bought and paid for by the taxpayers, but by a banking system taken over by Wall

Street gamblers. The banking debacle of

2008 caused credit to collapse, businesses to go bankrupt, and unemployment to

soar, drastically reducing the federal tax base. If anyone should be held to account, it is

Wall Street; but the bankers were bailed rather than jailed, and the taxpayers

got billed for the crime.

We

have been deluded into thinking that “fiscal responsibility” is something for

our benefit, something we actually need in order to save the country from

bankruptcy. In fact, it has simply been

an excuse to impose radical austerity measures on the people, measures that

benefit the 1% while locking the 99% in a dungeon of debt peonage.

Heads They Win, Tails We Lose

It is no great surprise that with only days to go, the congressional “super committee,” given the herculean task of carving an additional $1.2 trillion out of the federal budget, has failed to reach agreement. Why should six Republicans and six Democrats with diametrically opposed views agree in a few weeks, when Congress couldn’t shake hands on it after months of wrangling, despite the guillotine blade of a federal default hanging over their heads? It is no great surprise that with only days to go, the congressional “super committee,” given the herculean task of carving an additional $1.2 trillion out of the federal budget, has failed to reach agreement. Why should six Republicans and six Democrats with diametrically opposed views agree in a few weeks, when Congress couldn’t shake hands on it after months of wrangling, despite the guillotine blade of a federal default hanging over their heads?

Whether the super committee reaches agreement or not, however, the deficit hawks win. If they agree, either $1.2 trillion gets cut from the budget or taxes go up by that amount; and the committee co-chair has categorically stated taxes are not going up, so that means the budget will be cut. If agreement is not reached, $1.2 trillion in cuts automatically kick in, split evenly between domestic and military spending. Either way, the economy will wind up with $1.2 trillion less in the way purchasing power. The result will be to reduce demand, kill jobs, and put more people on the streets.

Read more...

Sunday, 13 November 2011 21:35

by Ellen Russell

... about The Economy

Neoliberalism drives chronic worldwide financial instability

From Wall Street to Iceland to Greece to Ireland, the world is lurching from one financial crisis to another. The financial panic of 2008 has morphed into the era of financial crises. If you think you live in an oasis secure from financial meltdown, think again. Financial markets are so twitchy (and so interdependent) that a problem anywhere could become a problem everywhere. From Wall Street to Iceland to Greece to Ireland, the world is lurching from one financial crisis to another. The financial panic of 2008 has morphed into the era of financial crises. If you think you live in an oasis secure from financial meltdown, think again. Financial markets are so twitchy (and so interdependent) that a problem anywhere could become a problem everywhere.How did we become hostage to financial markets? We’re in this mess because a generation of neoliberal finance set the stage for chronic worldwide financial instability:

1. Inequality has become much worse: Worldwide, we have seen a growing trend for wealth and income to become more unequally distributed. In a more egalitarian society, regular folks use their slice of the economic pie to do regular stuff like buy a car or repair the roof, which sets the stage for real economic activity (the production of goods and services). When the affluent get their hands on a greater piece of the economic pie, they don’t need the extra cash for daily living. Instead, they can use these funds to fuel financial speculation.

Read more...

Wednesday, 02 November 2011 23:50

by Bob Chapman

... about The Economy

Those who believe the European crisis is over are mistaken. The

dislocation will continue as their economies slow and political, social and

economic events converge into further crisis. The most glaring problem is the

banks only taking a 50% loss on Greek bonds. The loss should have been 75% or

even 80%. There is absolutely no way Greece can overcome that burden in a

slowing European economy and an enraged population. They are still striking and

demonstrating and they will continue even under a new government.

Some

of the best economists in the world have been saying for almost as long as we

have been saying that the weaker and smaller countries have to leave the euro at

least temporarily. In our eyes that really means permanently. If Italy falls out

it will take France with it and the euro edifice will fall. Very quickly it will

be found that Greece cannot and will not recover. It is one thing to set

recovery in motion in good times, but it is another to attempt to do so under

austerity. These politicians in Europe have been self-serving. They are quickly

going to find what they have done is not going to work. Greece should have never

been saved, as we said from the beginning. They will need more and more money

just to exist and you cannot have perpetual funding. Then you have the

overriding social factor. It is simply impossible and once Greece goes, the

other 5 will have to cut loose as well. Again, it will be called temporary, but

their exists will be permanent. It simply cannot be any other way. Political hot

air is not going to change anything. We have no details and bankers who refuse

to face the music, and what is attempted to be achieved is impossible.

The concept of a tighter union with a new constitution won’t work

either. We can go back to 1991 when these issues came forth and we stated the

Europeans are doing this backwards. You need a strong constitution first, only

nations involved that can meet the criteria of public debt of 3% GDP. Smaller

nations cannot be allowed to falsify their balance sheets and above all you

cannot use one interest rate for all. Just about everything that has been done

has been done incorrectly. Unfortunately, the US and world economy hang in the

balance as well. This euro, European and UK problem is not going to go away. By

February it will again be front page news. There is an 80% chance that Greece

will leave the euro in the next six months.

If Ireland and Portugal do

not receive equal treatment, followed by Belgium, Spain and Italy, then they

will all be forced to leave the euro. If you think for one minute that these

nations can stand more than a year or two of austerity you are mistaken. The

whole approach is wrong. They should all be allowed to leave the euro. The only

reason Greece has been temporarily saved is to keep Greece in the euro. These

one-worlders cannot bear to see their dream of world government fail. It has

already failed. Do you really think Germans are going to give up their

sovereignty? Wait for the next German election. You are going to see a house

cleaning in the Bundestag that will be staggering. The German people are

outraged at what these politicians have done to them. If anything the move in

the EU’s strongest economy will be away from further consolidation, not toward

it.

The magic number to keep the euro from collapsing over the next two

years is $6 trillion that solvent European countries do not have, and using

derivatives in place of cash is a prescription for disaster. Debt may be

addressed, but the core economic and financial problems that were responsible

for these problems are still not being addressed. That is a glaring lack of

economic progress. Where is the capital needed for growth? Countries in the EU

are going to have to increase money and credit and suffer the incumbent

inflation; that is if they can even raise those funds and rollover old debt.

Either that or China will lend $3 to $500 billion and we don’t think they are

willing to do that. If China prints the money to lend, the value of the yuan

will fall, the Chinese will take more market share and there will be more

inflation. Their goods sold to Europe, the US and elsewhere will rise in cost as

well. The Chinese will have to use cash euros or sell euro bonds. Such moves

could be really upsetting to China. If aid comes it will be in much smaller

amounts.

This past week the swaps association said the failure on 50% of

Greek debt does not constitute failure, because it was voluntary, so the NYC

legacy banks do not have to pay up on their derivative bet. That could all

change, because Fitch says it does constitute default. We will now have to await

the decisions of S&P and Moody’s.

What Europe has done is pull a page

from US bailouts, which reduce debt starting in a few years, which would extend

over 10 or 20 years. It reminds us of the two sets of books banks are currently

keeping. They intend to write off bad debt over 50 years, like it really didn’t

exist. This plan allows further current increases in debt over the short term.

That is no solution at all. Again, it only throws the debt and service into a

future that could include deflationary depression. Recovery is not a

given.

Fitch has really opened a large can of worms in calling a 50% debt

default a payable derivative event. We are talking about hundreds of billions of

CD’s, credit default swaps OTC derivatives, which just happens to be an

unregulated market. Our view is Fitch is correct and the ISDA, the derivatives

information agency is wrong. What isn’t made an issue of is that banks have been

asked to raise $150 billion they are offside on this issue. We projected this

number long ago. The official number is $3.7 billion, which is laughable. About

a month ago the players admitted to $75 billion, so we are making progress

toward truth and reality. We wonder what the French bankers are saying, who

bought the insurance? If NYC banks do not pay off the ECB will have to create

the $150 billion and lend it to the banks in France, so they can survive. Could

this be a renege? We think so, and that would ultimately allow citizens of the

EU to pay the debt. These bankers are crafty buggers they are.

We also

question why banks are writing off 50% of their debt and the sovereigns are not.

Isn’t this strange? Why are they not writing off 50%? Could it be that if they

did they would be insolvent? Could it be to deceive their taxpaying citizens and

pop the question several years from now? Could this be they are just trying to

extend the timeline into the future? Time has a way of revealing everything.

Incidentally, none of that Greek debt will probably ever be paid off. It should

also be noted that of the $140 billion lent by the IMF, US taxpayers are on the

hook for about 30%, or $42 billion. We are sure that will make Americans very

happy.

The difference between $516 billion allocated by EU members, half of

which comes from Germany, and $1.4 trillion will come from the sale of bonds by

the EFSF, the European Financial Stabilization Fund. The question is who is

going to buy this tranche of some $900 billion in bonds? Nations will receive

greater taxes from a phantom recovery and buy the bonds. How can this be when

those economies barely have even GDP growth? All this in the midst of austerity.

We do not get it. We must be missing something. Does Italy really believe that

raising the retirement age from 65 to 67 is going to bring any real immediate

relief? As you can see the case is terminal.

The whole plan is absurd,

stupid and unworkable. These problems are going to last for years as Europe, the

UK and US wallow in negative growth and eventually in deflationary

depression.

Greece will collapse; it is only a question of when. The ECB will

continue to create money and credit, just as the US and UK are doing.

It

won’t take long for investors to figure out they have been bamboozled again.

They will flee stock markets probably just after the Fed’s latest QE 3 is

announced. Some will buy US Treasuries and lose about 10% of their purchasing

power annually. Some will flee to commodities and many will use the flight to

quality to purchase gold and silver coins, bullion and shares. Modes of

investments are going to change dramatically, so you had best participate, or

you may end up losing most of your wealth.

What you are witnessing is

financial chicanery at its best. Wait until the citizens of Europe discover they

are going to have to pay all these bills, just so they can be enslaved in a

one-world government. They are not going to be happy.

We always tend to

be ahead of the curve and the crowd. This time the time frame for discovery may

be very short, because once investors understand what we have written here they

will want to get out. Gold, silver and commodities will rise for different

reasons, along with the flight to quality. Incidentally, this time the gold and

silver mining shares will soar.

Reflecting back on our comments the

second Greek bailout does not solve the EMU’s fundamental problem, which is the

30% competitiveness gap between the northern and southern countries and

Germany’s giant-EMU trade surplus at the expense of the south. Unless a way can

be found to rectify that there cannot be a recovery. The south has been forced

into austerity, which limits their chances of being competitive. As we pointed

out over and over again the end product will be a deflationary spiral and

eventually deflationary depression. What the IMF and EU members are imposing on

the six countries is very destructive.

A fiscal union would perhaps work,

but that means the end of individual country sovereignty, which would eventually

lead to authoritarianism, which would not like to see. The entire union is

unnatural and should be ended. It has been a failure and just leave it at

that.

All this program is going to do is buy time. It is not a long-term

solution. Current debt holders are going to be incensed, as they will be forced

in before sovereigns, but will banks really take a 50% haircut? We don’t really

know. Is this really a fig leaf, a wholly inadequate alternative to the ECB,

which cannot provide endless liquidity?

This rescue effort is really too

dependent on high-risk deals, such as what caused this crisis. Four times

leverage is outrageous. In the end the European public could get caught holding

the bag.

At the same time we are seeing monetary contraction in Portugal,

which mirrors that of Greece as it spiraled out of control. Bank deposits are

off 21% over the past six months and that could well be a precursor of a weak

economy and monetary trouble.

Another question that arises is due to the

treatment accorded to NYC legacy, money center banks. Will those using credit

default swaps continue to do so. There is a default and because it was voluntary

the derivative writers do not have to pay off. Give us a break. It looks like

contract law no longer exists.

In very late breaking news we find something

we warned about is happening. The German High Court, the Bundesgerichtshof, has

issued an express order that the nine-member committee dealing with dispersing

the rescue funds is not allowed to do so. The plug has been pulled on the EU and

German politicians on money releases. If the Germans and the EU are lucky

they’ll have a constitutional decision by Christmas. We predicted this would

happen.

Uncertainty revolves around the deal reached with Greek

bondholders to face a 50% haircut on the face value of their bonds. This has not

been negotiated as yet.

At the same time France needs to raise $11.2

billion to keep its AAA rating. Sarkozy says 2012 GDP growth will be about 1%,

about the same as Germany, but no one mentions it would be -2% with

inflation.

Switzerland’s State Secretariat for International Financial

Matters said the Swiss were interested in investing in a special investment

vehicle proposed by the euro zone bailout fund, but we see a real fight brewing.

The Swiss People’s Party, which was against franc devaluation and the sale of

Swiss gold, will be after this move by the Swiss government. They do not want

closer ties to the EU.

This past summer we warned that European banks

would have to increase their reserve position to 9%, because both the BIS and

IMF said it was absolutely necessary. You might call the EU’s laxity of not

forcing Greece to implement its austerity agreement as part of a socialist

mindset. There was no way to move Greece into line. For not living up to their

commitment they could have cut Greece off, because then they would default and

leave the euro. Thus, they continued to fund Greece. The truth is they have to

do so irrespective of what Greece does or doesn’t do.

The heart of the

problem was banking incompetence followed by sovereign stupidity. Banks and

solvent sovereigns never should have made the loans in the first place. All the

greedy bankers, politicians and bureaucrats could think of was the euro zone and

the euro being the template for one-world government. The interconnectivity of

banks within nations with banks of other nations is the lynchpin that will

eventually take all of them down. It’s caused by central control such as that

embodied in the European Central Bank. The bottom line is if a state like

Greece, partially defaults, then the banks within Greece default as well because

these banks are holding large amounts of federal bonds and loans. Thus, the

edifice collapses. This relationship exists all over Europe and as we are seeing

six countries are in trouble and if the European economy continues to slip into

recession or depression other countries will join the six. In addition in many

countries supervision is all but non-existent. A perfect example of such a

relationship was with France, Belgium, and the Dexia bank, which they created.

As a result the taxpayers of Belgium and France have acquired all the bad assets

of Dexia.

Adding to such problems is that usually half of the debt of

any country is held by foreign banks and sovereigns, which means failure becomes

contagion. France’s holding of 8.5% of GDP of debt from these six countries will

eventually cause France to lose its AAA rating. If that is the case we venture

to ask how can France be party to a commitment to bail out Greece or anyone

else? They simply cannot and they are the number 2 player. You would think

French citizens would elect someone who was not involved in such stupidities,

such as Marine LePen of the National Party. The banks and business interests,

such as the Rothschilds, couldn’t have that – could they? If France financially

fails we could see 1789 all over again. This sovereign debt is widely held by

other nations including the US, UK and Japan. European banks have controlled

European society for a long, long time and they are the catalyst for the new

world order.

We hear over and over again there will be recovery, we will

grow our way out of it. That won’t be possible for Europe, the UK and the US.

The number of young people who do the largest part of consumer spending in their

20s and 30s today have a hard time making ends meet, never mind spending. On top

of that many are unemployed and may be for some time to come. If you have

noticed unemployment has risen or stayed the same in the regions we have spoken

of. Accumulation has only occurred among the upper-middle class and the wealthy.

This also means borrowing has fallen and the ability to access loans and capital

are limited, because so many prime age borrowers do not qualify.

One of

the reasons Germany does as well as it does is because they have an abundancy of

inexpensive capital available for loans and credit, which allows expansion,

creates jobs and brings profits. The cost of labor is low or in the form of

growing productivity and people pay their bills.

One interest rate fits

all became a disaster. The weak participants borrowed at 4% instead of 8% and

the result was an orgy of spending that ended up in today’s insolvencies. We

said 12 years ago this would destroy the euro zone and it has. These low rates

also allowed a massive influx of imports into the six problem countries, which

caused major balance of trade deficits. This also brought about borrowing in

foreign currencies, which turned into a nightmare, particularly in Eastern

Europe.

European banking and politics are very closely intertwined. In

other words the banks overtly run these countries. The same is true in the UK,

but in the US it has been subtler due to ignorance of how the banking system

works and that has been deliberate. In Europe the stress test used 5% as a

guideline, instead of the normal 10%. This shows you the power and control

banking has over EU government making the margin for error extremely thin.

Considering the exposure cash reserves were increased to 9%. This means capital

has to be raised and that is not easy in today’s recessionary environment.

Two-thirds of European banks are currently under 9%. The worst exposed are RBS,

Deutsche Bank, Unicredit, Bank Paribas, Barclays and Societ General. Hundreds of

billions of euros are needed and the question is where will they come from? In

addition how many banks are shuffling assets between trading, deposit, and

banking sectors, such as Dexia had been doing until they had to be taken over by

the French and Belgium governments? The banks need $270 billion that is readily

available. If funds are not available then that means governments will have to

supply the capital from out of thin air, which is very inflationary.

The

EFSF, the European Financial Stability Facility, which was set up to aid Greece,

Ireland and Portugal, now aids banks and European governments, such as the Fed

does. An EFSF if allowed to dispense $1.4 trillion based on a $900 billion

derivative structure would take months to move into action. Then there is the

question will the German High court allow leveraging. We do not think so. The

Court had already told the Bundestage you cannot do that, but they did it

anyway.

As we can say is stay tuned for the next episode in this saga. It

could end up taking down the entire world’s financial system.

Towards Global Financial Collapse?

Those who believe the European crisis is over are mistaken. The dislocation will continue as their economies slow and political, social and economic events converge into further crisis. The most glaring problem is the banks only taking a 50% loss on Greek bonds. The loss should have been 75% or even 80%. There is absolutely no way Greece can overcome that burden in a slowing European economy and an enraged population. They are still striking and demonstrating and they will continue even under a new government. Those who believe the European crisis is over are mistaken. The dislocation will continue as their economies slow and political, social and economic events converge into further crisis. The most glaring problem is the banks only taking a 50% loss on Greek bonds. The loss should have been 75% or even 80%. There is absolutely no way Greece can overcome that burden in a slowing European economy and an enraged population. They are still striking and demonstrating and they will continue even under a new government.

Some of the best economists in the world have been saying for almost as long as we have been saying that the weaker and smaller countries have to leave the euro at least temporarily. In our eyes that really means permanently. If Italy falls out it will take France with it and the euro edifice will fall. Very quickly it will be found that Greece cannot and will not recover.

It is one thing to set recovery in motion in good times, but it is another to attempt to do so under austerity. These politicians in Europe have been self-serving. They are quickly going to find what they have done is not going to work. Greece should have never been saved, as we said from the beginning. They will need more and more money just to exist and you cannot have perpetual funding. Then you have the overriding social factor. It is simply impossible and once Greece goes, the other 5 will have to cut loose as well. Again, it will be called temporary, but their exists will be permanent. It simply cannot be any other way. Political hot air is not going to change anything. We have no details and bankers who refuse to face the music, and what is attempted to be achieved is impossible.

The concept of a tighter union with a new constitution won’t work either. We can go back to 1991 when these issues came forth and we stated the Europeans are doing this backwards. You need a strong constitution first, only nations involved that can meet the criteria of public debt of 3% GDP. Smaller nations cannot be allowed to falsify their balance sheets and above all you cannot use one interest rate for all. Just about everything that has been done has been done incorrectly. Unfortunately, the US and world economy hang in the balance as well. This euro, European and UK problem is not going to go away. By February it will again be front page news. There is an 80% chance that Greece will leave the euro in the next six months.

If Ireland and Portugal do not receive equal treatment, followed by Belgium, Spain and Italy, then they will all be forced to leave the euro. If you think for one minute that these nations can stand more than a year or two of austerity you are mistaken. The whole approach is wrong. They should all be allowed to leave the euro. The only reason Greece has been temporarily saved is to keep Greece in the euro. These one-worlders cannot bear to see their dream of world government fail. It has already failed. Do you really think Germans are going to give up their sovereignty? Wait for the next German election. You are going to see a house cleaning in the Bundestag that will be staggering. The German people are outraged at what these politicians have done to them. If anything the move in the EU’s strongest economy will be away from further consolidation, not toward it.

The magic number to keep the euro from collapsing over the next two years is $6 trillion that solvent European countries do not have, and using derivatives in place of cash is a prescription for disaster. Debt may be addressed, but the core economic and financial problems that were responsible for these problems are still not being addressed. That is a glaring lack of economic progress. Where is the capital needed for growth? Countries in the EU are going to have to increase money and credit and suffer the incumbent inflation; that is if they can even raise those funds and rollover old debt. Either that or China will lend $3 to $500 billion and we don’t think they are willing to do that. If China prints the money to lend, the value of the yuan will fall, the Chinese will take more market share and there will be more inflation. Their goods sold to Europe, the US and elsewhere will rise in cost as well. The Chinese will have to use cash euros or sell euro bonds. Such moves could be really upsetting to China. If aid comes it will be in much smaller amounts.

This past week the swaps association said the failure on 50% of Greek debt does not constitute failure, because it was voluntary, so the NYC legacy banks do not have to pay up on their derivative bet. That could all change, because Fitch says it does constitute default. We will now have to await the decisions of S&P and Moody’s.

What Europe has done is pull a page from US bailouts, which reduce debt starting in a few years, which would extend over 10 or 20 years. It reminds us of the two sets of books banks are currently keeping. They intend to write off bad debt over 50 years, like it really didn’t exist. This plan allows further current increases in debt over the short term. That is no solution at all. Again, it only throws the debt and service into a future that could include deflationary depression. Recovery is not a given.

Fitch has really opened a large can of worms in calling a 50% debt default a payable derivative event. We are talking about hundreds of billions of CD’s, credit default swaps OTC derivatives, which just happens to be an unregulated market. Our view is Fitch is correct and the ISDA, the derivatives information agency is wrong. What isn’t made an issue of is that banks have been asked to raise $150 billion they are offside on this issue. We projected this number long ago. The official number is $3.7 billion, which is laughable. About a month ago the players admitted to $75 billion, so we are making progress toward truth and reality. We wonder what the French bankers are saying, who bought the insurance? If NYC banks do not pay off the ECB will have to create the $150 billion and lend it to the banks in France, so they can survive. Could this be a renege? We think so, and that would ultimately allow citizens of the EU to pay the debt. These bankers are crafty buggers they are.

We also question why banks are writing off 50% of their debt and the sovereigns are not. Isn’t this strange? Why are they not writing off 50%? Could it be that if they did they would be insolvent? Could it be to deceive their taxpaying citizens and pop the question several years from now? Could this be they are just trying to extend the timeline into the future? Time has a way of revealing everything. Incidentally, none of that Greek debt will probably ever be paid off. It should also be noted that of the $140 billion lent by the IMF, US taxpayers are on the hook for about 30%, or $42 billion. We are sure that will make Americans very happy.

The difference between $516 billion allocated by EU members, half of which comes from Germany, and $1.4 trillion will come from the sale of bonds by the EFSF, the European Financial Stabilization Fund. The question is who is going to buy this tranche of some $900 billion in bonds? Nations will receive greater taxes from a phantom recovery and buy the bonds. How can this be when those economies barely have even GDP growth? All this in the midst of austerity. We do not get it. We must be missing something. Does Italy really believe that raising the retirement age from 65 to 67 is going to bring any real immediate relief? As you can see the case is terminal.

The whole plan is absurd, stupid and unworkable. These problems are going to last for years as Europe, the UK and US wallow in negative growth and eventually in deflationary depression.

Greece will collapse; it is only a question of when. The ECB will continue to create money and credit, just as the US and UK are doing.

It won’t take long for investors to figure out they have been bamboozled again. They will flee stock markets probably just after the Fed’s latest QE 3 is announced. Some will buy US Treasuries and lose about 10% of their purchasing power annually. Some will flee to commodities and many will use the flight to quality to purchase gold and silver coins, bullion and shares. Modes of investments are going to change dramatically, so you had best participate, or you may end up losing most of your wealth.

What you are witnessing is financial chicanery at its best. Wait until the citizens of Europe discover they are going to have to pay all these bills, just so they can be enslaved in a one-world government. They are not going to be happy.

We always tend to be ahead of the curve and the crowd. This time the time frame for discovery may be very short, because once investors understand what we have written here they will want to get out. Gold, silver and commodities will rise for different reasons, along with the flight to quality. Incidentally, this time the gold and silver mining shares will soar.

Reflecting back on our comments the second Greek bailout does not solve the EMU’s fundamental problem, which is the 30% competitiveness gap between the northern and southern countries and Germany’s giant-EMU trade surplus at the expense of the south. Unless a way can be found to rectify that there cannot be a recovery. The south has been forced into austerity, which limits their chances of being competitive. As we pointed out over and over again the end product will be a deflationary spiral and eventually deflationary depression. What the IMF and EU members are imposing on the six countries is very destructive.

A fiscal union would perhaps work, but that means the end of individual country sovereignty, which would eventually lead to authoritarianism, which would not like to see. The entire union is unnatural and should be ended. It has been a failure and just leave it at that.

All this program is going to do is buy time. It is not a long-term solution. Current debt holders are going to be incensed, as they will be forced in before sovereigns, but will banks really take a 50% haircut? We don’t really know. Is this really a fig leaf, a wholly inadequate alternative to the ECB, which cannot provide endless liquidity?

This rescue effort is really too dependent on high-risk deals, such as what caused this crisis. Four times leverage is outrageous. In the end the European public could get caught holding the bag.

At the same time we are seeing monetary contraction in Portugal, which mirrors that of Greece as it spiraled out of control. Bank deposits are off 21% over the past six months and that could well be a precursor of a weak economy and monetary trouble.

Another question that arises is due to the treatment accorded to NYC legacy, money center banks. Will those using credit default swaps continue to do so. There is a default and because it was voluntary the derivative writers do not have to pay off. Give us a break. It looks like contract law no longer exists.

In very late breaking news we find something we warned about is happening. The German High Court, the Bundesgerichtshof, has issued an express order that the nine-member committee dealing with dispersing the rescue funds is not allowed to do so. The plug has been pulled on the EU and German politicians on money releases. If the Germans and the EU are lucky they’ll have a constitutional decision by Christmas. We predicted this would happen.

Uncertainty revolves around the deal reached with Greek bondholders to face a 50% haircut on the face value of their bonds. This has not been negotiated as yet.

At the same time France needs to raise $11.2 billion to keep its AAA rating. Sarkozy says 2012 GDP growth will be about 1%, about the same as Germany, but no one mentions it would be -2% with inflation.

Switzerland’s State Secretariat for International Financial Matters said the Swiss were interested in investing in a special investment vehicle proposed by the euro zone bailout fund, but we see a real fight brewing. The Swiss People’s Party, which was against franc devaluation and the sale of Swiss gold, will be after this move by the Swiss government. They do not want closer ties to the EU.

This past summer we warned that European banks would have to increase their reserve position to 9%, because both the BIS and IMF said it was absolutely necessary. You might call the EU’s laxity of not forcing Greece to implement its austerity agreement as part of a socialist mindset. There was no way to move Greece into line. For not living up to their commitment they could have cut Greece off, because then they would default and leave the euro. Thus, they continued to fund Greece. The truth is they have to do so irrespective of what Greece does or doesn’t do.

The heart of the problem was banking incompetence followed by sovereign stupidity. Banks and solvent sovereigns never should have made the loans in the first place. All the greedy bankers, politicians and bureaucrats could think of was the euro zone and the euro being the template for one-world government. The interconnectivity of banks within nations with banks of other nations is the lynchpin that will eventually take all of them down. It’s caused by central control such as that embodied in the European Central Bank. The bottom line is if a state like Greece, partially defaults, then the banks within Greece default as well because these banks are holding large amounts of federal bonds and loans. Thus, the edifice collapses. This relationship exists all over Europe and as we are seeing six countries are in trouble and if the European economy continues to slip into recession or depression other countries will join the six. In addition in many countries supervision is all but non-existent. A perfect example of such a relationship was with France, Belgium, and the Dexia bank, which they created. As a result the taxpayers of Belgium and France have acquired all the bad assets of Dexia.

Adding to such problems is that usually half of the debt of any country is held by foreign banks and sovereigns, which means failure becomes contagion. France’s holding of 8.5% of GDP of debt from these six countries will eventually cause France to lose its AAA rating. If that is the case we venture to ask how can France be party to a commitment to bail out Greece or anyone else? They simply cannot and they are the number 2 player. You would think French citizens would elect someone who was not involved in such stupidities, such as Marine LePen of the National Party. The banks and business interests, such as the Rothschilds, couldn’t have that – could they? If France financially fails we could see 1789 all over again. This sovereign debt is widely held by other nations including the US, UK and Japan. European banks have controlled European society for a long, long time and they are the catalyst for the new world order.

We hear over and over again there will be recovery, we will grow our way out of it. That won’t be possible for Europe, the UK and the US. The number of young people who do the largest part of consumer spending in their 20s and 30s today have a hard time making ends meet, never mind spending. On top of that many are unemployed and may be for some time to come. If you have noticed unemployment has risen or stayed the same in the regions we have spoken of. Accumulation has only occurred among the upper-middle class and the wealthy. This also means borrowing has fallen and the ability to access loans and capital are limited, because so many prime age borrowers do not qualify.

One of the reasons Germany does as well as it does is because they have an abundancy of inexpensive capital available for loans and credit, which allows expansion, creates jobs and brings profits. The cost of labor is low or in the form of growing productivity and people pay their bills.

One interest rate fits all became a disaster. The weak participants borrowed at 4% instead of 8% and the result was an orgy of spending that ended up in today’s insolvencies. We said 12 years ago this would destroy the euro zone and it has. These low rates also allowed a massive influx of imports into the six problem countries, which caused major balance of trade deficits. This also brought about borrowing in foreign currencies, which turned into a nightmare, particularly in Eastern Europe.

European banking and politics are very closely intertwined. In other words the banks overtly run these countries. The same is true in the UK, but in the US it has been subtler due to ignorance of how the banking system works and that has been deliberate. In Europe the stress test used 5% as a guideline, instead of the normal 10%. This shows you the power and control banking has over EU government making the margin for error extremely thin. Considering the exposure cash reserves were increased to 9%. This means capital has to be raised and that is not easy in today’s recessionary environment. Two-thirds of European banks are currently under 9%. The worst exposed are RBS, Deutsche Bank, Unicredit, Bank Paribas, Barclays and Societ General. Hundreds of billions of euros are needed and the question is where will they come from? In addition how many banks are shuffling assets between trading, deposit, and banking sectors, such as Dexia had been doing until they had to be taken over by the French and Belgium governments? The banks need $270 billion that is readily available. If funds are not available then that means governments will have to supply the capital from out of thin air, which is very inflationary.

The EFSF, the European Financial Stability Facility, which was set up to aid Greece, Ireland and Portugal, now aids banks and European governments, such as the Fed does. An EFSF if allowed to dispense $1.4 trillion based on a $900 billion derivative structure would take months to move into action. Then there is the question will the German High court allow leveraging. We do not think so. The Court had already told the Bundestage you cannot do that, but they did it anyway.

As we can say is stay tuned for the next episode in this saga. It could end up taking down the entire world’s financial system.

Copyright © Bob Chapman, Global Research, 2011

Thursday, 27 October 2011 22:52

by Richard K Moore

... about The Economy

When the Industrial Revolution began in Britain, in the late 1700s, there was lots of money to be made by investing in factories and mills, by opening up new markets, and by gaining control of sources of raw materials. The folks who had the most money to invest, however, were not so much in Britain but more in Holland. Holland had been the leading Western power in the 1600s, and its bankers were the leading capitalists. In pursuit of profit, Dutch capital flowed to the British stock market, and thus the Dutch funded the rise of Britain, who subsequently eclipsed Holland both economically and geopolitically. When the Industrial Revolution began in Britain, in the late 1700s, there was lots of money to be made by investing in factories and mills, by opening up new markets, and by gaining control of sources of raw materials. The folks who had the most money to invest, however, were not so much in Britain but more in Holland. Holland had been the leading Western power in the 1600s, and its bankers were the leading capitalists. In pursuit of profit, Dutch capital flowed to the British stock market, and thus the Dutch funded the rise of Britain, who subsequently eclipsed Holland both economically and geopolitically. In this way British industrialism came to be dominated by wealthy investors, and capitalism became the dominant economic system. This led to a major social transformation. Britain had been essentially an aristocratic society, dominated by landholding families. As capitalism became dominant economically, capitalists became dominant politically. Tax structures and import-export policies were gradually changed to favour investors over landowners.

Read more...

Monday, 24 October 2011 23:21

by Dr. Paul Craig Roberts

... about The Economy

Totally Corrupt America

Last March I reviewed Matt Taibbi's important book Griftopia, an entertaining account of the through-going financial fraud that gave us the financial crisis. http://www.vdare.com/print/13156 Taibbi shows that the US "superpower" can match any third world backwater in the magnitude of greed and fraud that is endemic in business and government. I would not be surprised if Taibbi's book motivated the more aware participants of Occupy Wall Street. Last March I reviewed Matt Taibbi's important book Griftopia, an entertaining account of the through-going financial fraud that gave us the financial crisis. http://www.vdare.com/print/13156 Taibbi shows that the US "superpower" can match any third world backwater in the magnitude of greed and fraud that is endemic in business and government. I would not be surprised if Taibbi's book motivated the more aware participants of Occupy Wall Street.

Taibbi's Griftopia was published last year. This year Henry Holt publishers have provided us with Gretchen Morgenson and Joshur Rosner's Reckless Endangerment.

Morgenson and Rosner tell the story again, but with less drama and provocation. Possibly, it might be more acceptable to those gullible Americans who wrap themselves in the flag and refuse to believe that their country could ever knowingly do anything that is wrong.

Read more...

Friday, 02 September 2011 15:44

by Ellen Brown

... about The Economy

North Dakota’s Economic “Miracle”—It’s Not Oil

Global Research, September 2, 2011

Yes Magazine

North Dakota has had the nation's lowest unemployment ever since the economy tanked. What's its secret? North Dakota has had the nation's lowest unemployment ever since the economy tanked. What's its secret?In an article in The New York Times on August 19th titled “The North Dakota Miracle,” Catherine Rampell writes:

Forget the Texas Miracle. Let’s instead take a look at North Dakota, which has the lowest unemployment rate and the fastest job growth rate in the country.

According to new data released by the Bureau of Labor Statistics today, North Dakota had an unemployment rate of just 3.3 percent in July—that’s just over a third of the national rate (9.1 percent), and about a quarter of the rate of the state with the highest joblessness (Nevada, at 12.9 percent).

North Dakota has had the lowest unemployment in the country (or was tied for the lowest unemployment rate in the country) every single month since July 2008.

Read more...

Monday, 29 August 2011 20:25

By Joe Bageant

... about The Economy

December 06, 2006

Muffled noises from the ranks of the babbling paranoid

It's hard as hell to keep conspiracy theories out of one's mind these days. And I'm not talking about "Who really brought down the Twin Towers? or the "Are Zionists behind the Iraq War?" kind of stuff. The booger stalking my ragged old mind these days puts both of those in the shade. And it runs like this: It's hard as hell to keep conspiracy theories out of one's mind these days. And I'm not talking about "Who really brought down the Twin Towers? or the "Are Zionists behind the Iraq War?" kind of stuff. The booger stalking my ragged old mind these days puts both of those in the shade. And it runs like this:Is the consumerist totalization of this country and the world really a conscious plot by a handful of powerful corporate and financial masters? If we answer "yes" we find ourselves trundled off toward the babbling ranks of the paranoid. Still though, it's easy enough to name those who would piss themselves with joy over the prospect of a One World corporate state, with billions of people begging to work for their 1,500 calories a day and an x Box chip in their necks. It's too bad our news media quit hunting with live ammo decades ago, leaving us with no one to track the activities and progress of what sure as hell seem to be global elites, judging from the financial spoor we find along every pathway of modern life.

In our saner moments we can also see that it does not take dark super-centralized plotting to pull off what appears to have been accomplished.

Read more...

Saturday, 20 August 2011 20:04

Ian Rae Macdonald

... about The Economy

Just what do we call the richest 1% who have used their money and power to control politicians and law makers around the world to ensure they can take more and more of the pie while the ones at the bottom are to be seen as the thieves? Just what do we call the richest 1% who have used their money and power to control politicians and law makers around the world to ensure they can take more and more of the pie while the ones at the bottom are to be seen as the thieves?

Okay, if I loot a shop I am a criminal. If I loot an entire country or two I am...what? An "elite?"

How ironic that the Prime Minister of Britain can apparently only speak of what he also wants us to see.

"The prime minister also said that his commitment to tackling the "greed and thuggery" seen during the riots and episodes of looting would be backed up by "the full force of the law".

"We need a stronger police presence on the streets, deterring crime and catching criminals instead of filling in forms or wasting time on phoney targets," he said."

Funny how the "Greatest Heist of Taxpayers Money in History" gets no mention.

For the youth of not only Britian but pretty well the rest of the world hope is but a far away dream. "Auterity Measures" which are so openly being talked about and implemented have been destroying the very social fabric of our societies in the "Western" countries doesn't seem to have had any blame in the riots. Less and less civil rights in every so called democracy in the world cannot possible have contributed to the angry and frustration seen in the streets of Britian. Yet, he speaks of the "Greed and Thuggery" of the looters.

The "elite" have used every means available to them and created new ones along the way, to ensure that the legislation in countries around the world has been weaken enough to allow them to rape and pillage the economies of every nation in the world in the name of "Globalisation". They have bought the politicians, the media and supplied us with their Think Tanks to ensure they will get away with it. We have seen them use our military's to enforce "Freedom" when in fact thery want no such thing. Instead the milary have become their private police forces around the world to ensure even more economies can be raped and pillaged.

Yet let anyone speak up about this injustice and just watch the force of the law come down upon there heads, literally. Do we see the same treatment for the criminals in financial centres around the world as the "looters"?

Hell no!

The "elites" are ready for the next round of "Bailouts" with open arms and just watch the bonuses this time as they instill enough debt on the world's citizens to demand the sell off and "Privatization" of the rest of the peoples assets. Pure Corp0ratism at its worst.

Maybe the "elites" will find out about "the full force of the law" one day soon. Maybe the causes of the French Revolution could give these people a tip or two?

Notes:

1. BBC http://www.bbc.co.uk/news/uk-14605459

Saturday, 20 August 2011 18:38

by Bob Chapman

... about The Economy

The Fed has been behind all the failings of the markets, Europe now a disaster waiting to happen, about leveraged speculation and counterparty risk, now we have an escalating debt crisis, the perpetual creation of money is the theft of the value of labor due to the inflation that is caused. The Fed has been behind all the failings of the markets, Europe now a disaster waiting to happen, about leveraged speculation and counterparty risk, now we have an escalating debt crisis, the perpetual creation of money is the theft of the value of labor due to the inflation that is caused.

Every professional has their own method of analyzing markets, finance and economies, and some do well coming up with the direction of social and political issues as well. The other 97% miss one-half to two-thirds of the time. That is not very good and one asks why? The answer is simple they really haven’t studied history as well as they should have.

Some believe that the crisis in Europe is the heart of today’s problems. It certainly is a strong integral part, but not the primary causation. The 3-year old finance bubble was created by the Federal Reserve, which began the situation starting in 1993. We saw the dotcom boom, which they could have stopped in its tracks. All they had to do is raise margin requirements from 50% to 60% temporarily. After that collapse in mid-March 2000, they decided rather than purge the systems, as they as well should have done in 1990-92, they created another bubble in real estate. They have been trying to recover from that bubble and other layover problems since we’d say 2000.

Read more...

Monday, 15 August 2011 20:56

by Prof. James K. Galbraith

... about The Economy

Fixing the economy: We got it wrong

In early January 2009 two White House-bound economists — Christina Romer and Jared Bernstein — predicted that if the stimulus bill were passed, unemployment would peak at 8% by midyear and then start coming down. If there were no stimulus, they said, joblessness might hit 9% and not peak until 2010. In early January 2009 two White House-bound economists — Christina Romer and Jared Bernstein — predicted that if the stimulus bill were passed, unemployment would peak at 8% by midyear and then start coming down. If there were no stimulus, they said, joblessness might hit 9% and not peak until 2010.

Romer and Bernstein had the risky job of hyping policy, but they weren't alone in their optimistic views. Forecasters at the Congressional Budget Office, the Federal Reserve and most private banks all thought that the economy had a natural tendency to right itself, sooner or later. What it needed, the activists urged, was a push.

Well it's now obvious that the push didn't do the job. Even with it, unemployment is higher than the Romer-Bernstein worst case. The optimistic forecasts now look embarrassing, ranking right up there alongside Irving Fisher's 1929 comment that stocks had reached "a permanently high plateau."

Read more...

Monday, 01 August 2011 13:58

by sturdyblog

... about The Economy

Battle in Syntagma Square

What is going on in Athens at the moment is resistance against an invasion; an invasion as brutal as that against Poland in 1939. The invading army wears suits instead of uniforms and holds laptops instead of guns, but make no mistake – the attack on our sovereignty is as violent and thorough. Private wealth interests are dictating policy to a sovereign nation, which is expressly and directly against its national interest. Ignore it at your peril. Say to yourselves, if you wish, that perhaps it will stop there. That perhaps the bailiffs will not go after the Portugal and Ireland next. And then Spain and the UK. But it is already beginning to happen. This is why you cannot afford to ignore these events. What is going on in Athens at the moment is resistance against an invasion; an invasion as brutal as that against Poland in 1939. The invading army wears suits instead of uniforms and holds laptops instead of guns, but make no mistake – the attack on our sovereignty is as violent and thorough. Private wealth interests are dictating policy to a sovereign nation, which is expressly and directly against its national interest. Ignore it at your peril. Say to yourselves, if you wish, that perhaps it will stop there. That perhaps the bailiffs will not go after the Portugal and Ireland next. And then Spain and the UK. But it is already beginning to happen. This is why you cannot afford to ignore these events.The powers that be have suggested that there is plenty to sell. Josef Schlarmann, a senior member of Angela Merkel’s party, recently made the helpful suggestion that we should sell some of our islands to private buyers in order to pay the interest on these loans, which have been forced on us to stabilise financial institutions and a failed currency experiment. (Of course, it is not a coincidence that recent studies have shown immense reserves of natural gas under the Aegean sea).

Read more...

Monday, 01 August 2011 09:00

by Patrick Martin

... about The Economy

President Barack Obama made a brief White House appearance Sunday night to announce that an agreement had been reached with Republican and Democratic congressional leaders to raise the federal debt ceiling before Tuesday's deadline set by the Treasury. Speaking in advance of the opening of financial markets in Asia, Obama thanked "the leaders of both parties" and said the deal would "allow us to avoid default." President Barack Obama made a brief White House appearance Sunday night to announce that an agreement had been reached with Republican and Democratic congressional leaders to raise the federal debt ceiling before Tuesday's deadline set by the Treasury. Speaking in advance of the opening of financial markets in Asia, Obama thanked "the leaders of both parties" and said the deal would "allow us to avoid default."The agreement, which must still be voted on by the Senate and the House of Representatives, imposes unprecedented cuts on domestic social spending without a single dollar of increased taxes on the wealthy.

Read more...

Thursday, 21 July 2011 19:21

by Dr. Paul Craig Roberts

... about The Economy

Recently, the bond rating agencies that gave junk derivatives

triple-A ratings threatened to downgrade US Treasury bonds if the White House

and Congress did not reach a deficit reduction deal and debt ceiling increase.

The downgrade threat is not credible, and neither is the default threat. Both

are make-believe crises that are being hyped in order to force cutbacks in

Medicare, Medicaid, and Social Security.

If the rating agencies downgraded Treasuries, the company

executives would be arrested for the fraudulent ratings that they gave to the

junk that Wall Street peddled to the rest of the world. The companies would be

destroyed and their ratings discredited. The US government will never default on

its bonds, because the bonds, unlike those of Greece, Spain, and Ireland, are

payable in its own currency. Regardless of whether the debt ceiling is raised,

the Federal Reserve will continue to purchase the Treasury’s debt. If Goldman

Sachs is too big to fail, then so is the US government.

There is no budget focus on the illegal wars and military

occupations that the US government has underway in at least six countries or the

66-year old US occupations of Japan and Germany and the ring of military bases

being constructed around Russia.

The total military/security budget is in the vicinity of

$1.1-$1.2 trillion, or 70% -75% of the federal budget deficit.

In contrast, Social Security is solvent. Medicare expenditures

are coming close to exceeding the 2.3% payroll tax that funds Medicare, but it

is dishonest for politicians and pundits to blame the US budget deficit on

“entitlement programs.”

Entitlements are funded with a payroll tax. Wars are not

funded. The criminal Bush regime lied to Americans and claimed that the Iraq war

would only cost $70 billion at the most and would be paid for with Iraq oil

revenues. When Bush’s chief economic advisor, Larry Lindsay, said the Iraq

invasion would cost $200 billion, the White House Moron fired him. In fact,

Lindsay was off by a factor of 20. Economic and budget experts have calculated

that the Iraq and Afghanistan wars have consumed $4,000 billion in out-of-pocket

and already incurred future costs. In other words, the ongoing wars and

occupations have already eaten up the $4 trillion by which Obama hopes to cut

federal spending over the next ten years. Bomb now, pay later.

As taxing the rich is not part of the political solution, the

focus is on rewarding the insurance companies by privatizing Medicare at some

future date with government subsidized insurance premiums, by capping Medicaid,

and by loading the diminishing middle class with additional Social Security tax.

Washington’s priorities and those of its presstitutes could not

be clearer. President Obama, like George W. Bush before him, both parties in

Congress, the print and TV media, and National Public Radio have made it clear

that war is a far more important priority than health care and old age pensions

for Americans.

The American people and their wants and needs are not

represented in Washington. Washington serves powerful interest groups, such as

the military/security complex, Wall Street and the banksters, agribusiness, the

oil companies, the insurance companies, pharmaceuticals, and the mining and

timber industries. Washington endows these interests with excess profits by

committing war crimes and terrorizing foreign populations with bombs, drones,

and invasions, by deregulating the financial sector and bailing it out of its

greed-driven mistakes after it has stolen Americans’ pensions, homes, and jobs,

by refusing to protect the land, air, water, oceans and wildlife from polluters

and despoilers, and by constructing a health care system with the highest costs

and highest profits in the world.

The way to reduce health care costs is to take out gobs of

costs and profits with a single payer system. A private health care system can

continue to operate alongside for those who can afford it.

The way to get the budget under control is to stop the

gratuitous hegemonic wars, wars that will end in a nuclear confrontation.

The US economy is in a deepening recession from which recovery

is not possible, because American middle class jobs in manufacturing and

professional services have been offshored and given to foreigners. US GDP,

consumer purchasing power, and tax base have been handed over to China, India,

and Indonesia in order that Wall Street, shareholders, and corporate CEOs can

earn more.

When the goods and services produced offshore come back into

America, they arrive as imports. The trade balance worsens, the US dollar

declines further in exchange value, and prices rise for Americans, whose incomes

are stagnant or falling.

This is economic destruction. It always occurs when an

oligarchy seizes control of a government. The short-run profits of the powerful

are maximized at the expense of the viability of the economy.

The US economy is driven by consumer demand, but with 22.3%

unemployment, stagnant and declining wages and salaries, and consumer debt

burdens so high that consumers cannot borrow to spend, there is nothing to drive

the economy.

Washington’s response to this dilemma is to increase the

austerity! Cutting back Medicare, Medicaid, and Social Security, forcing down

wages by destroying unions and offshoring jobs (which results in a labor surplus

and lower wages), and driving up the prices of food and energy by depreciating

the dollar further erodes consumer purchasing power. The Federal Reserve can

print money to rescue the crooked financial institutions, but it cannot rescue

the American consumer.

As a final point, confront the fact that you are even lied to

about “deficit reduction.” Even if Obama gets his $4 trillion “deficit

reduction” over the next decade, it does not mean that the current national debt

will be $4 trillion less than it currently is. The “reduction” merely means that

the growth in the national debt will be $4 trillion less than otherwise.

Regardless of any “deficit reduction,” the national debt ten years from now will

be much higher than it presently is.

Dr. Roberts was Assistant Secretary of the

US Treasury, Associate Editor of the Wall Street Journal, and professor of

economics in six universities.

The Enemy Is Washington

Recently, the bond rating agencies that gave junk derivatives triple-A ratings threatened to downgrade US Treasury bonds if the White House and Congress did not reach a deficit reduction deal and debt ceiling increase. The downgrade threat is not credible, and neither is the default threat. Both are make-believe crises that are being hyped in order to force cutbacks in Medicare, Medicaid, and Social Security.

If the rating agencies downgraded Treasuries, the company executives would be arrested for the fraudulent ratings that they gave to the junk that Wall Street peddled to the rest of the world. The companies would be destroyed and their ratings discredited. The US government will never default on its bonds, because the bonds, unlike those of Greece, Spain, and Ireland, are payable in its own currency. Regardless of whether the debt ceiling is raised, the Federal Reserve will continue to purchase the Treasury's debt. If Goldman Sachs is too big to fail, then so is the US government.

Read more...

Friday, 04 February 2011 22:30

by grtv

... about The Economy

I

n times of crisis people seek strong leaders and simple solutions. But what if their solutions are identical to the mistakes that caused the very crisis? This is the story of the greatest economic crisis of our age, the one that awaits us.

Overdose: The Next Financial Crisis

Read more...

Thursday, 27 January 2011 20:53

Real News

... about The Economy

Real News interview with Prof. Michael Hudson

Thursday, 16 December 2010 17:04

by Bruce Campbell

... about The Economy

Neoliberalism cause of the worst recession since the 1930s…

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly supposed. Indeed, the world is ruled by little else.” - John Maynard Keynes< “The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly supposed. Indeed, the world is ruled by little else.” - John Maynard Keynes<

Ideas matter greatly in determining the shape and direction of our society.

The ideas underlying economic policy-making affect our lives in many ways: what is produced; the conditions under which production takes place; how production impacts the natural environment, the size and distribution of income from production; and, of course, the balance between public goods and services paid for through our taxes, and those produced by the private sector and paid for with individual incomes via the market.

Read more...

Wednesday, 15 December 2010 18:54

by Murray Dobbin

... about The Economy

Last May, the OECD put out figures comparing infant mortality rates in countries around the world. Perhaps the biggest story of all the figures were those attributed to Canada. This country has always boasted of its social stats — life expectancy, infant mortality, university graduates, and other measures of our success as a nation. Last May, the OECD put out figures comparing infant mortality rates in countries around the world. Perhaps the biggest story of all the figures were those attributed to Canada. This country has always boasted of its social stats — life expectancy, infant mortality, university graduates, and other measures of our success as a nation.

But not this time.

The numbers were “shocking” — a word used by half a dozen prominent commentators, including the Conference Board of Canada. We had slipped from sixth place in the world to 24, a virtually unprecedented fall for any country. We are now just above Poland and Hungary, with 5.1 deaths per 1,000 live births of infants less than one year of age. The actual tragedy beyond the percentages: 1,181 infant deaths in 2007.

Read more...

Thursday, 25 November 2010 20:40

by Murray Dobbin

... about The Economy

Citizen Psychopaths

National governments have been back in the news over the past two years because of the financial crisis and the havoc it wreaked on the global economy. Belying the ideology that nations were obsolete in the grand new order of transnational corporations, they are now front and centre trying to save the corporations that supposedly had replaced them. That is, saving them from themselves — from their greed, overreach, hubris and sheer incompetence. National governments have been back in the news over the past two years because of the financial crisis and the havoc it wreaked on the global economy. Belying the ideology that nations were obsolete in the grand new order of transnational corporations, they are now front and centre trying to save the corporations that supposedly had replaced them. That is, saving them from themselves — from their greed, overreach, hubris and sheer incompetence.

Yet there is a disturbing silence about the role of corporations in the world as if these private institutions are somehow immutable — created by the heavens and something we have to live with, like the weather. We need to change our way of thinking because corporations are the Frankenstein monsters that will destroy the planet. No amount of so-called “good corporate citizenship” or investment in wind power or electric cars will change this fact — the most important fact that the planet will deal with (or not) in the next century. Imagine what you will regarding what “we” have to do to save the planet. Unless we dismantle this perverse institution and take away its power, the world will descend into another dark age.

Read more...

Friday, 29 October 2010 00:24

by Joe Bageant

... about The Economy

Is the 'digital hive' a soft totalitarian state?

Ferrara, Italy Ferrara, Italy

Sitting in a trendy wine bar, one of those that brings out food to match your particular choice of wine, mystified by the table setting. What was that tiny baby spoon for? Cappuccino surely, at some point, but why no big spoon to go with the knife and fork? The things a redneck American does not know grow exponentially in Bella Italia, starting with the restaurants -- not to mention several civilizations beneath one’s feet. Being in a house that has been continuously occupied for over 1000 years -- resisting the temptation to piss in the hotel room bidet, that sort of thing.

Read more...

Thursday, 28 October 2010 22:54

by Andrew Gavin Marshall

... about The Economy

Engineering a Global Depression to Create a Global Government

The following is a sample from an forthcoming book by Andrew Gavin Marshall on 'Global Government', Global Research Publishers, Montreal. For more by this author on the issue of the economic crisis and global governance, see the recently-released book by Global Research "The Global Economic Crisis: The Great Depression of the XXI Century," Michel Chossudovsky and Andrew Gavin Marshall, (Editors), in which the author contributed three chapters on the history of central banking, the rise of a global currency and global central bank, and the political economy of global government.

Problem, Reaction, Solution: “Crisis is an Opportunity” Problem, Reaction, Solution: “Crisis is an Opportunity”

In May of 2010, Dominique Strauss-Kahn, Managing Director of the IMF, stated that, “crisis is an opportunity,” and called for “a new global currency issued by a global central bank, with robust governance and institutional features,” and that the “global central bank could also serve as a lender of last resort.” However, he stated, “I fear we are still very far from that level of global collaboration.”[1] Well, perhaps not so far as it might seem.

Read more...

Wednesday, 20 October 2010 18:39

by Andrew Gavin Marshall

... about The Economy

The role of the corporate elites' secretive global think tanks